OSR Holdings, Inc. (OSRH) — Market & Strategy Snapshot

OSR Holdings, Inc. (OSRH) — Market & Strategy Snapshot

OSR Holdings, Inc. (OSRH) — Market & Strategy Snapshot

Stock Jump Sparks Buzz

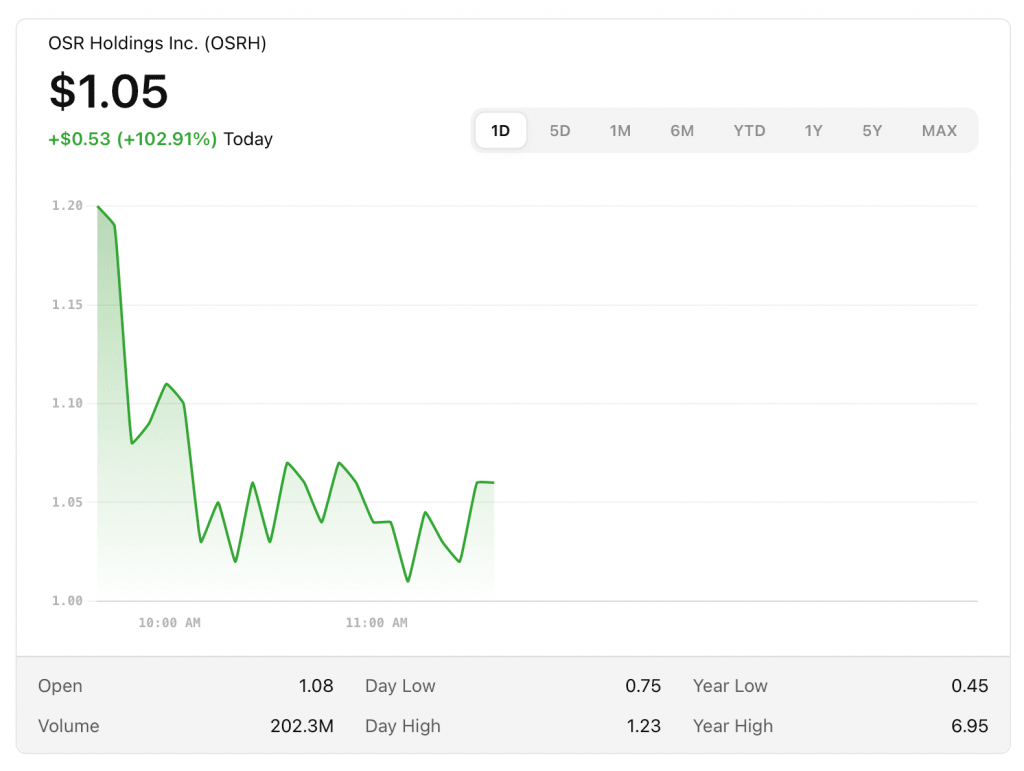

OSR Holdings (NASDAQ: OSRH), a healthcare-focused blank-check company, has exploded in the market today. The stock surged over 100% intraday, driven by a massive 106.8% jump on extraordinary volume of 188 million shares. This sharp rise signals a liquidity event—possibly algorithmic trading or a short squeeze—rather than fundamental news.AInvest+1

Behind the Headlines: What’s PPushing OSR?

Strategic Headlines Spark Optimism

While the intraday spike lacks concrete catalysts, analysts and traders point to recent strategic updates—including new partnerships and a planned acquisition—as the foundation for renewed confidence.StocksToTradeAInvest

Corporate Strategy in Motion

OSR is advancing its pipeline through a term sheet to acquire Woori IO, a South Korean firm specializing in non-invasive glucose monitoring. Shareholders may convert shares upon OSRH reaching $10, a sign of long-term ambition.osr-holdings.com+2StocksToTrade+2Seeking Alpha+5Stock Titan+5StockAnalysis+5

The company has also raised equity via White Lion GBM, directing proceeds into R&D and expanding its digital health portfolio.Stock Titan+3Seeking Alpha+3Finviz+3

Volatility Remains Elevated

OSRH trades at a very low market cap (~$11M), with t‑12 revenue of zero, a negative net income, and only a handful of employees. Chart patterns show high volatility: a 52-week range from $0.45 to $13.40.AInvesttradingview.com+1

Investor’s Brief Overview

| Category | Insight |

| Stock Surge | Up >100% intraday amid ultra-high volume |

| Driver | Likely due to speculative trading amid strategic news hints |

| Fundamentals | Pre-revenue, speculative healthcare holding with significant execution risk |

| Catalysts Ahead | Woori IO acquisition, blockchain/token strategy, R&D pushes |

| Risk Assessment | Highly volatile—suitable only for aggressive, speculative investors |

Final Thoughts (Retail Investor Outlook)

OSR Holdings is a speculative micro-cap stock riding the wave of strategic headlines and surge-driven trading activity. With its pre-revenue status and high volatility, it’s not a play for conservative portfolios—but prime territory for traders watching catalysts and momentum.

If you’re tracking OSR Holdings, keep an eye on updates related to the Woori IO acquisition, tokenization efforts, and any formal R&D partnerships or trial results. These developments will be real value drivers—not just the market hype.

Join our community to participate in comments, rate stocks, receive daily updates, and more.

SIMILAR NEWSLETTER

Small Cap Network

Small Cap Network

Small Cap Network

Small Cap Network

SIMILAR ARTICLES

Forget Fitbit (FIT). Biotricity (BTCY) Has the Heart Monitor People Can Actually Use

James E. Brumley

Forget Fitbit (FIT). Biotricity (BTCY) Has the Heart Monitor People Can Actually Use

James E. Brumley

Forget Fitbit (FIT). Biotricity (BTCY) Has the Heart Monitor People Can Actually Use

James E. Brumley

?