CIGL's nearly 100% jump is attention-grabbing

CIGL Nearly Doubles on Heavy Volume—Is This Momentum or Meme Mania?

Market Snapshot

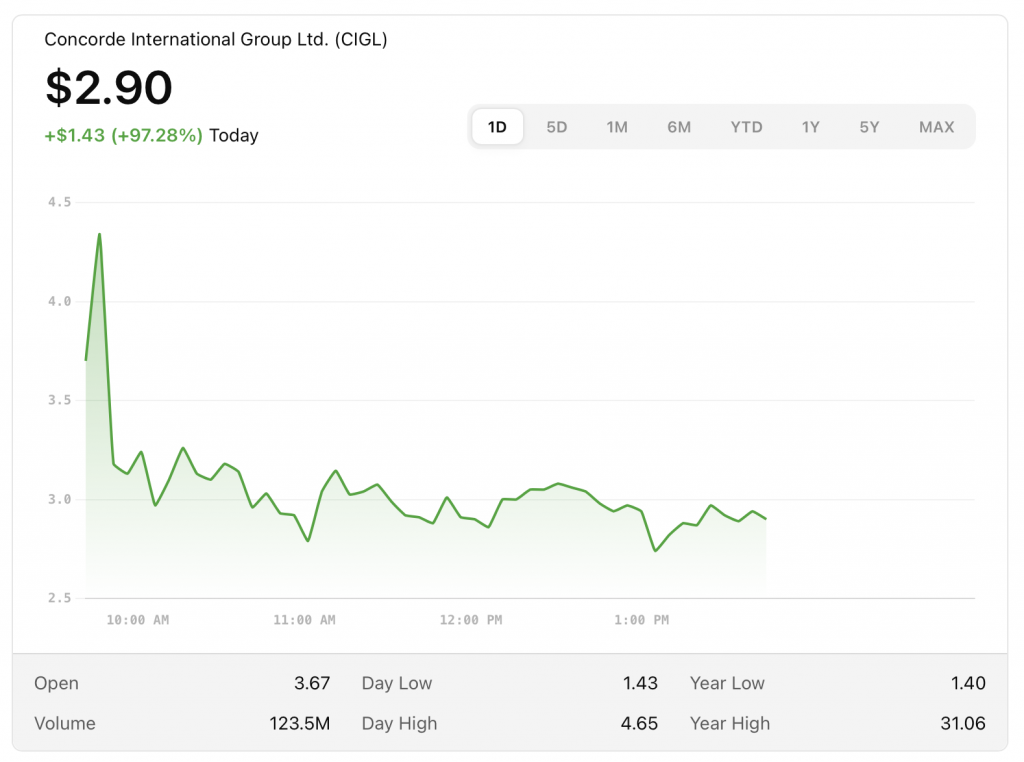

Concorde International Group Ltd. (NASDAQ: CIGL) surged nearly 100% intraday, rallying from USD 1.47 to a peak of USD 4.74, before settling near USD 2.90—its current price as of this afternoon. Trading volume exploded, eclipsing 123 million shares, far beyond its typical float.

TradingView+9StockAnalysis+9Finviz+9

Such extreme volatility is rare—even in small caps—but today, CIGL turned heads. Early buzz suggests a mix of speculative retail trading and sporadic headlines, with no single clear trigger. Yet, the spike does highlight the challenges—and opportunities—investing in hyper-volatile, near-penny small-cap stocks.

Company Profile & Recent Catalysts

Who is Concorde International Group Ltd.?

A Singapore-based security services provider founded in 1997, Concorde blends tech-driven and traditional security offerings—ranging from i‑Guarding, man-guarding, and mobile facility operations, to intelligent kiosks and visitor authentication systems. The company caters to commercial, industrial, and government clients.

TradingView+4StockAnalysis+4Investing.com+4

Recent developments that may underpin investor interest:

A strategic partnership with Ryde Group Ltd.—to embed drivers into security roles—potentially expanding workforce capacity and diversifying services.

Secured SGD 11.6 million (~USD 9 million) in multi-year recurring revenue contracts, offering more visibility into future streams.

StockAnalysis+2Finviz+2

The company’s 2024 annual results revealed USD 10.49 million in revenue, offset by a USD 83.6 million net loss—reflecting heavy investment, early-stage operations, and limited scale.

StockAnalysisTradingView

It went public in April 2025, raising USD 5 million via an IPO, followed by the over-allotment closing—a common tactic to meet investor demand.

StockAnalysis+2Investing.com+2

Small-Cap Spotlight: The Anatomy of the Rally

What drove the near-doubling?

CIGL’s 52-week range spans USD 1.40 to USD 31.06, showing extreme past volatility. Today’s pop is part of that broader move in speculative small caps.

With a market cap around USD 32–64 million and only ~1.44 million shares outstanding, even moderate buying pressure can cascade into dramatic price swings.

Stocktwits+9StockAnalysis+9Investing.com+9MarketWatch+1

Insider ownership is very high—over 90%—with minimal institutional holdings (~0.17%) and low short interest (~0.7%). This suggests limited deep-pocketed involvement.

Finviz

Technical indicators show wild swings: RSI levels point toward oversold or overbought extremes; moving averages offer neutral-to-bullish short-term signals.

Investing.comSeeking Alpha

Bottom line? Today’s rally appears driven by speculative, thin-float dynamics—not a reappraisal of long-term valuation.

Market Color & Human Insight

Here’s where we add the SCN “human color”:

This feels like meme-stock dynamics transplanted into tiny-cap territory. With enormous daily swings, speculative chatter—perhaps circulated across social platforms or pump-and-dump forums—likely contributed. Without clear brokerage upgrades or analyst commentary, the rally remains detached from traditional valuation signals.

Despite securing contracts and partnerships, the company remains far from profitable (TTM net loss USD 83.6M). Margins are contracted, and revenue per employee stands near USD 78K annually—modest by industry standards.

Finviz

For perspective: even if the company scales, small earnings or recurring revenue may take years before lifting it out of penny-stock peril. High beta (~6.6), high volatility (over 100%), and negative return ratios underscore the fragility of investor positions.

TradingViewFinvizInvesting.com

What to Watch Next

Volume tomorrow

Sustained high volume could signal continuing momentum; a sharp drop-off could warn of a quick reversal.

Official updates

Any firm new contracts, earnings guidance, or Ryde/other partner developments could lend more substance to pricing.

Watch for sharp reversals

If this is speculative heat, early investors may cash out fast. Swing traders and retail momentum players could drive volatility.

Valuation metrics (if released)

Should Concorde publish forecasts or recurring revenue breakdowns, analysts could begin modeling potential breakout scenarios—though such coverage remains absent today.

Bottom Line

CIGL’s nearly 100% jump is attention-grabbing, but caution is essential. With minimal analyst coverage, persistent losses, and micro-cap volatility, the stock is speculative at best. That said, recent contracts and partnerships offer a glimmer of operational progress—not enough yet, but possible building blocks.

Investors should treat this as a high-risk scenario. Only commit capital if you’re comfortable with extreme volatility, limited reporting, and the possibility of total loss. For those intrigued by small-cap leaps, this is the kind of speculative volatility that might reward—or wipe out—fast movers.

Interested in smarter, fundamentals-driven small-cap ideas?

Hit reply or comment, and I’ll share a watchlist focused on cash flow-positive small caps, recurring revenue leaders, and emerging value plays with stronger financial footing.

By SCN Editorial Team

No AI was used in this newsletter.

For timely small-cap insights, subscribe now: https://smallcapnetwork.com/subscribe/

Join our community to participate in comments, rate stocks, receive daily updates, and more.

SIMILAR NEWSLETTER

Small Cap Network

Small Cap Network

Small Cap Network

Small Cap Network

SIMILAR ARTICLES

Forget Fitbit (FIT). Biotricity (BTCY) Has the Heart Monitor People Can Actually Use

James E. Brumley

Forget Fitbit (FIT). Biotricity (BTCY) Has the Heart Monitor People Can Actually Use

James E. Brumley

Forget Fitbit (FIT). Biotricity (BTCY) Has the Heart Monitor People Can Actually Use

James E. Brumley

?