Guide to Trading High-Volume, Low-Float Small Cap Stocks

Master volatility, spot momentum, and trade smarter with proven setups for explosive small cap movers.

1. Understand the Basics

Low Float means a limited number of shares are available to trade (typically under 10 million shares). These stocks move fast because it takes less volume to cause a large price change.

High Volume signals strong interest from traders and investors. Combined with low float, it often results in sharp price spikes or drops.

Key Concept: Small supply plus big demand leads to major volatility. That’s where the opportunity is.

2. Risk Management

Use tight stop-losses. Don’t risk more than 1 to 2 percent of your account per trade.

Size down if the float is under 5 million or if the stock is already up significantly pre-market.

Avoid overnight holds unless you have a catalyst-backed thesis. Most of these runners give up gains fast.

3. Top Chart Patterns for Low-Float Stocks

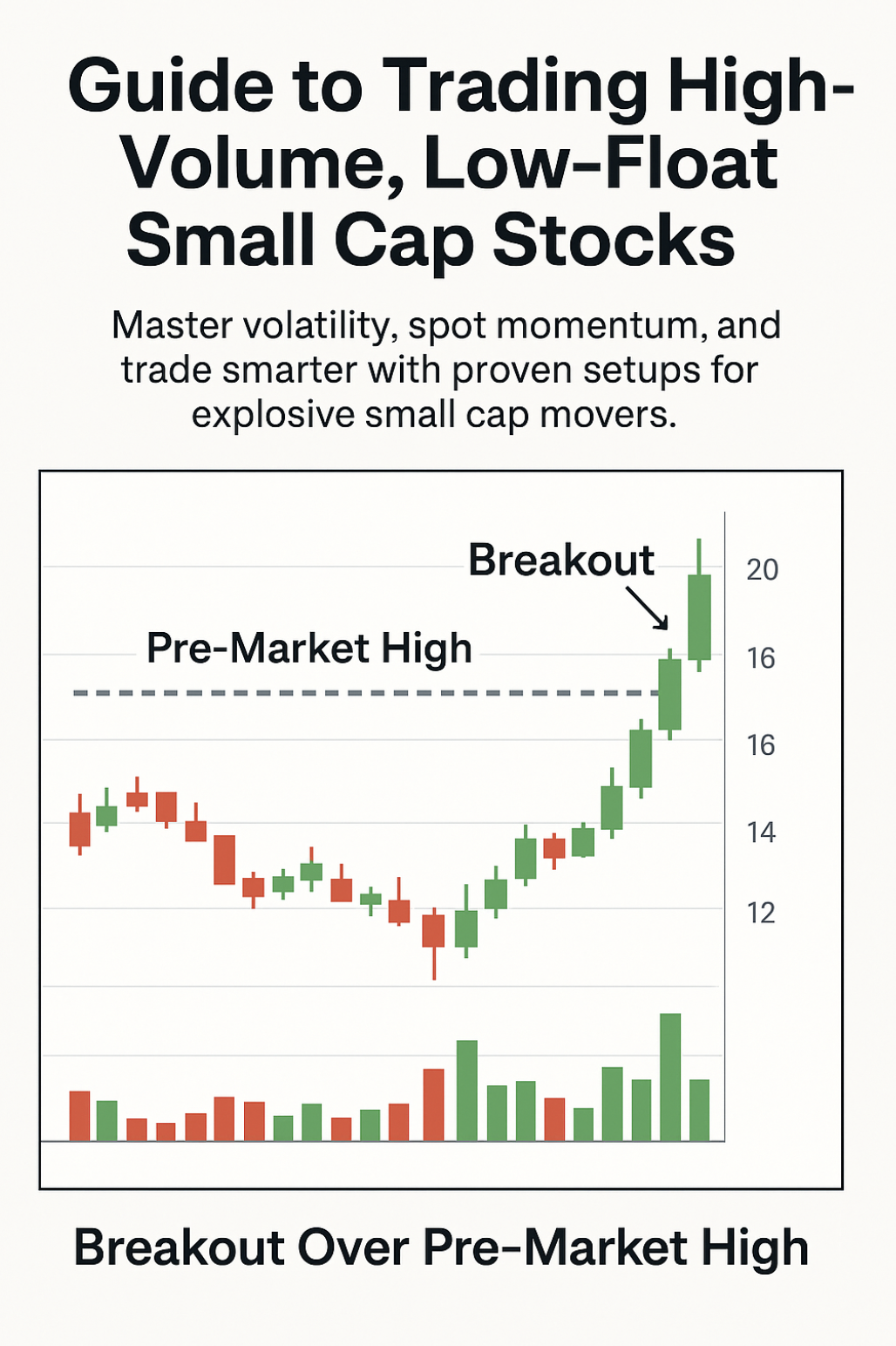

Breakout Over Pre-Market High

Wait for a confirmed breakout above the morning pre-market high on volume. This is often the first real move of the day.

VWAP Reclaim

If price dips below the VWAP line and reclaims it with volume, it often signals a second leg up. Ideal for late-morning entries.

Red-to-Green Move

The stock opens lower but crosses yesterday’s close and turns green. Great for early momentum.

Dip and Rip

A fast dip off the open followed by a strong bounce. Confirmation comes with a reclaim of support or VWAP.

Afternoon High-of-Day Break

After consolidation through midday, a surge past the high of the day can offer a strong breakout opportunity.

4. Key Indicators to Watch

Float size under 10 million

Relative Volume (RVOL) over 2 times the average

Short Interest can add fuel for squeezes

News Catalyst such as FDA approval, earnings, or contracts

Volume Buzz or Unusual Volume compared to average daily volume

5. Daily Scanner Criteria

Use these filters in your scanner:

Float: Under 10 million shares

Price: Between $0.50 and $10

Volume: Over 3 million shares today

Pre-market % Change: Over 15 percent

Catalyst: News, PR, FDA, earnings, etc.

Suggested platforms: Trade Ideas, Benzinga Pro, ThinkorSwim, TradingView, Webull

6. Psychological Rules

Don’t chase parabolic moves. Wait for pullbacks or reclaim levels.

Stick to your trading plan. Avoid revenge trading.

Recognize halt risks. Low floats often halt multiple times intraday.

Don’t trade out of boredom. Only enter setups with clear patterns and volume.

7. Daily Trading Routine

Pre-Market Scan: Use float and volume filters to build a watchlist.

Check for Catalysts: Look for credible news driving the move.

Map Key Levels: Pre-market high, VWAP, and prior day highs/lows.

Execute Your Plan: Define entry, stop-loss, and profit target before entry.

Journal the Trade: Record what worked and what didn’t for future improvement.