Trump Pushes Pro Crypto Strategy Featuring Bitcoin ETFs and Reserve Vision

Trump’s Strategic Crypto Playbook: Institutionalization, Regulation, and Sovereign Bitcoin Reserves

The Trump-era crypto policy marks a significant shift toward the institutionalization of digital assets, emphasizing Bitcoin ETFs, regulatory clarity, and the potential for a U.S. sovereign Bitcoin reserve.

Institutionalization and Macro Trends

Bitcoin adoption is now closely tied to macroeconomic developments and evolving U.S. regulatory frameworks. A proposed Strategic Bitcoin Reserve could serve as a major catalyst in the coming market cycle, especially if paired with comprehensive stablecoin legislation.

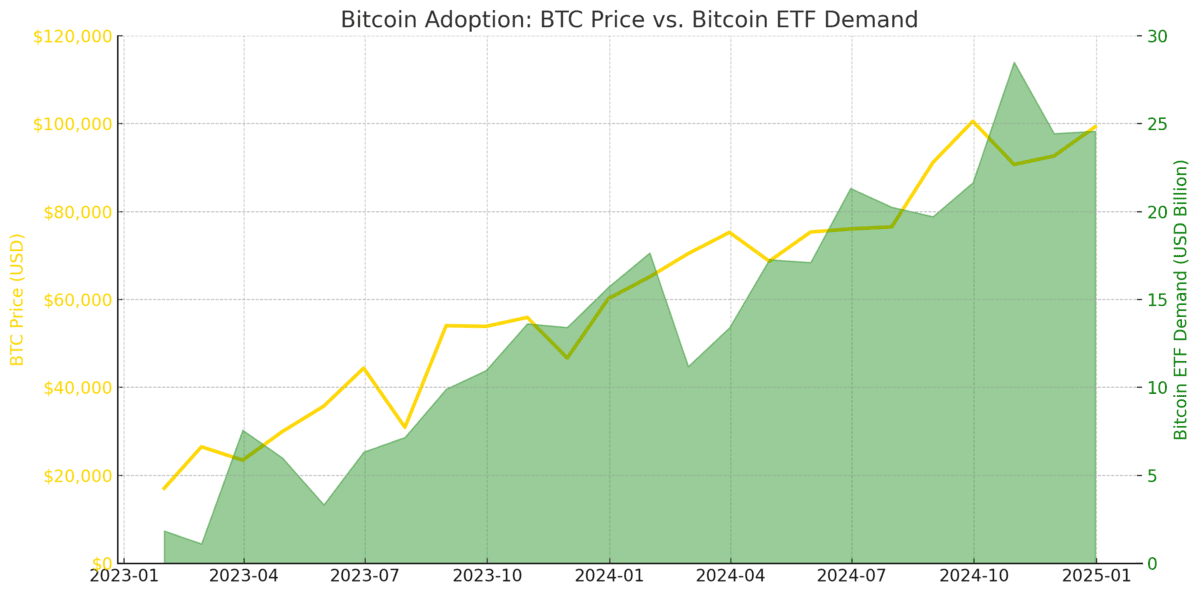

Currently, institutional demand is the primary driver behind Bitcoin’s price cycles. Open interest in CME Bitcoin futures has consistently exceeded $10 billion, reaching peaks above $20 billion — a sign of deep engagement from traditional financial players.

Regulation Paves the Way for Institutional Entry

The Trump administration’s policy actions have already enabled major players to enter the space. The repeal of SAB 121removed custody-related barriers, opening the door for institutions like JPMorgan and Citibank to explore crypto custody services.

Simultaneously, legislation like the FIT21 bill and the proposed GENIUS Act is laying the groundwork for long-term regulatory clarity. FIT21 divides regulatory responsibilities based on the nature of tokens: the SEC oversees centralized assets, while the CFTC governs decentralized ones. If passed, the GENIUS Act would provide a legal framework for banks and fintechs to issue dollar-backed stablecoins.

The Rise of Bitcoin ETFs — and the Risks Beneath

The approval of Bitcoin spot ETFs has transformed BTC into a formal investment product for U.S. institutions. As a result, basis trading—profiting from the spread between ETF and futures prices—has become widespread. However, much of this activity is leveraged arbitrage, which HTX Ventures warns could lead to significant ETF outflows and sudden price drops if those positions unwind quickly.

Still, ETFs have reshaped the investor base, attracting capital that treats Bitcoin more like a traditional asset. This has contributed to lower volatility and longer market cycles, aligning Bitcoin more closely with U.S. stock indices.

Strategic Reserve: The Next Big Catalyst?

While regulatory clarity and institutional interest continue to build, the U.S. has yet to initiate active Bitcoin reserve accumulation. According to HTX Ventures, this move—if enacted—could serve as the dominant driver of the next bull run.

They also suggest broader fiscal engineering could follow, potentially including controlled GDP contraction to justify monetary stimulus—a tactic used during the 2008 and 2020 crises. In such a scenario, Bitcoin reserves could become a sovereign hedge against fiat dilution.

Conclusion: From Hype to Sovereign Strategy

The current bull market differs fundamentally from past cycles driven by retail mania. According to Cointelegraph and HTX Ventures, this rally is built on legalization and dollarization—a structural shift positioning Bitcoin as a legitimate, sovereign-grade asset within the U.S. financial system.

As the Trump-era policies continue to unfold, the emphasis is clear: the future of crypto lies in institutional integration, regulatory clarity, and possibly, national-level Bitcoin strategy.

Join our community to participate in comments, rate stocks, receive daily updates, and more.

SIMILAR ARTICLES

?