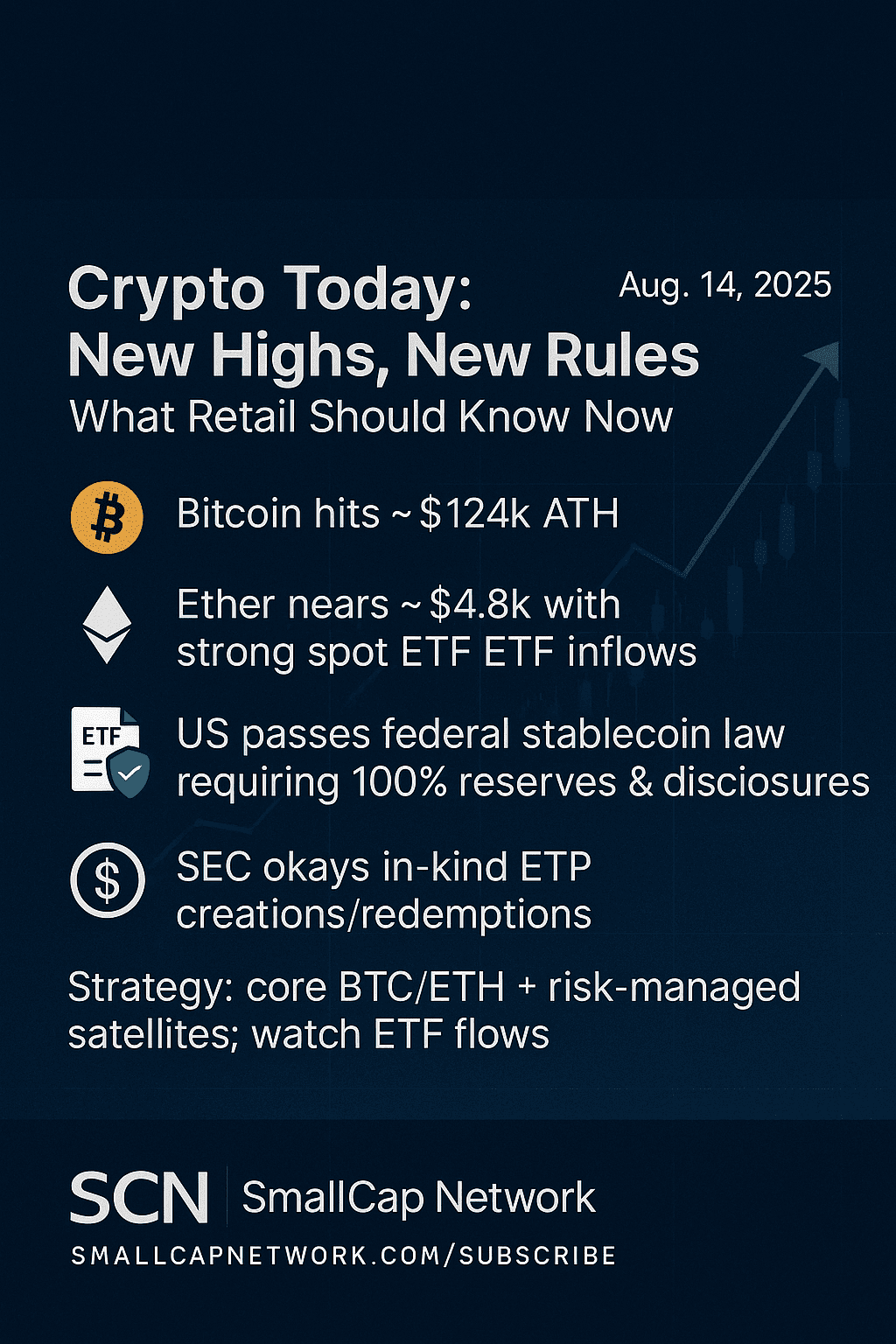

Crypto Today: New Highs, New Rules—What Retail Should Know Now

Crypto Today: New Highs, New Rules—What Retail Should Know Now

August 14, 2025 — SmallCap Network

Snapshot: Bitcoin set a fresh all-time high around $124k today as odds of a Fed rate cut and a friendlier U.S. policy backdrop turbo-charge flows. Ether pushed toward $4.8k, near its own records.

What’s driving the move

Macro tailwind: Markets are leaning into policy easing; that “lower-rates” bid has been a reliable updraft for risk assets, including crypto. Bitcoin’s new peak above $124k underscored the momentum.

Regulatory reset: The U.S. just enacted the GENIUS Act, the first federal stablecoin law, requiring 100% reserves and routine disclosures—big for trust and mainstream adoption.

Plumbing upgrades: The SEC approved in-kind creations/redemptions for crypto ETPs, reducing frictions and potentially improving ETF pricing/liquidity—important for sustained institutional inflows.

Legal overhang eases: The SEC–Ripple case has concluded with a fine, removing a marquee uncertainty around XRP and signaling a shift from litigation to clearer rule-making.

ETF demand, especially for ETH: U.S. spot Ether ETFs have seen surging inflows this month, a key pillar of ETH’s strength toward prior highs.

What it means for retail investors

Core vs. satellites: Consider a core position in BTC/ETH (the assets most directly benefiting from policy clarity and ETF demand), with smaller, research-backed satellite bets in themes you understand. (DeFi/L2s/stablecoin rails.)

Flows matter: Keep an eye on ETF net inflows (both BTC and ETH). Strong, sustained inflows often precede price breakouts; drying flows can foreshadow cool-offs.

Stablecoin yield & safety: The new U.S. framework should push issuers toward treasury-backed reserves and transparent reporting—use that to evaluate which stablecoins you hold or use on-ramps with.

Risk discipline: New highs bring higher volatility. Pre-set position sizes, stops, and time horizons; don’t extrapolate parabolic moves indefinitely.

Catalyst calendar: Watch for further U.S. policy steps (retirement-plan access rollouts), ETF flow updates, and any follow-through on global regulatory harmonization.

Bottom line: We’re in a structurally stronger phase than past cycles—ETF rails, stablecoin rules, and fading legal clouds are attracting durable capital. That’s bullish, but price will still move in waves. Build positions methodically and let the trend, not FOMO, do the work.

For immediate small cap news subscribe.

Join our community to participate in comments, rate stocks, receive daily updates, and more.

SIMILAR ARTICLES

?