Crypto Market Snapshot – October 23 2025

Crypto Market Snapshot – October 23 2025

By the SCN Editorial Team

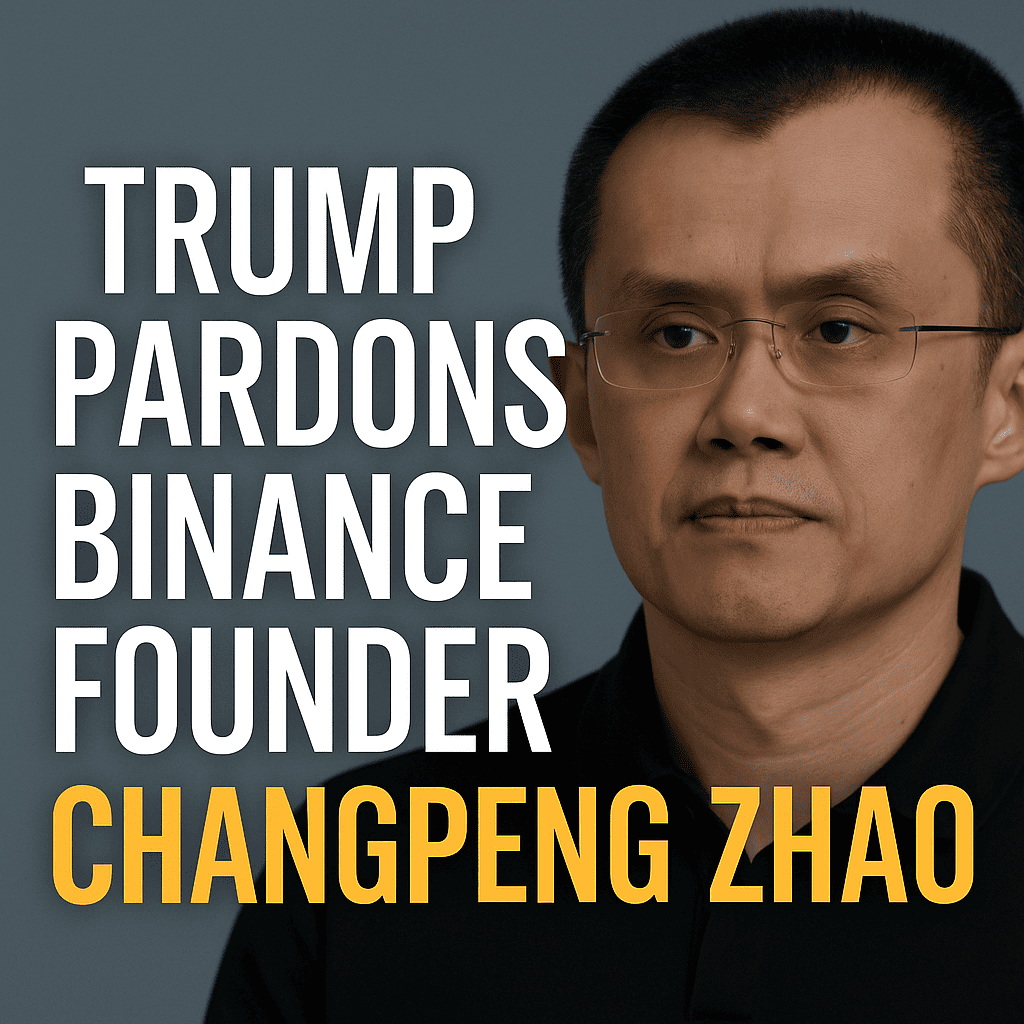

Today marks a pivotal moment in the cryptocurrency world. The headline news—Changpeng Zhao (also known as “CZ”), founder of Binance, has been pardoned by Donald Trump—may reshape regulatory perceptions, institutional opportunities, and risk calculations. Below, we walk through the major developments, why they matter, and what retail investors should keep an eye on.

1. Trump Pardons Binance Founder: What Changed?

In a surprise announcement on October 23, 2025, President Trump granted a full pardon to Changpeng Zhao, the former CEO and founder of Binance, who had served four months in prison after pleading guilty to anti-money-laundering violations. Value The Markets+3Reuters+3CoinDesk+3

Key Facts

Zhao pled guilty in November 2023 for failing to maintain required anti-money-laundering (AML) controls at Binance, and the exchange agreed to pay a $4.3 billion settlement with U.S. authorities. CoinDesk+2Quiver Quantitative+2

He completed a four-month federal prison sentence by September 2024. Quiver Quantitative+1

With the pardon, Zhao’s federal conviction is officially cleared, opening potential paths to re-engagement in U.S. regulated activities (subject to other restrictions and corporate governance constraints). BeInCrypto

The White House statement said the pardon “marks the end of the Biden administration’s war on cryptocurrency.” Investing.com

Why It Matters for Crypto

Regulatory Perception Shift: This pardon may signal a more favorable regulatory tone toward crypto innovation and major players in the industry, especially under the incoming administration. The market may interpret this as a green light for revived participation by large firms.

Corporate Governance Implications: Binance still has outstanding regulatory obligations from its settlement. But by clearing Zhao’s record, it may ease leadership and strategic constraints, which could impact Binance’s U.S. footprint or global partnerships.

Market Sentiment: The news triggered immediate speculation that tokens linked to Binance (e.g., BNB) and crypto sectors might benefit from renewed confidence. Even if actual operational changes take time, sentiment often precedes fundamentals.

Risk Management Reminder: While this is a positive signal, it does not eliminate regulatory risk entirely. The pardon is individual—not blanket protection for the industry—and regulatory enforcement remains a real possibility.

For retail investors, the takeaway is: this is a structural story, not a short-term trade. It changes the playing field but doesn’t guarantee smooth sailing. It warrants recalibrating risk/return expectations for major crypto platforms and projects tied to regulated entities.

2. Implications for Exchanges, Tokens & Institutional Access

Exchanges

With the founder of the largest crypto exchange granted clemency, we may observe accelerated efforts by exchanges to engage with U.S. regulated markets, perhaps through increased transparency, compliance upgrades, or strategic U.S. partnerships.

Exchanges formerly constrained by U.S. sanctions or leadership risks may push harder to enter or normalize U.S. operations.

Retail platforms should assess their exchange counterparties: an exchange stable in governance and compliance may carry less systemic risk.

Tokens

The native token of Binance, BNB, rose immediately on the pardon news. While token prices respond to sentiment, they still depend on fundamentals: usage, platform growth, regulatory status.

BNB may benefit if Binance expands services or ties into regulated products in the U.S.

But heightened expectations also raise risk: if Binance fails to deliver on U.S. expansion or compliance execution, the token could face a sharp pull-back.

Institutional and Retail Pathways

Institutional adoption trends may strengthen if regulatory uncertainty lessens. More regulated funds, custodians, ETFs and large-scale capital may enter the crypto space with greater confidence.

Retail investors should watch for:

New spot crypto ETF approvals tied to major assets or platforms

Custody arrangements tied to major regulated exchanges

Partnerships between exchanges, banks and financial institutions made possible by clearer regulatory visibility

3. Regulatory & Policy Ramifications – A Broader Context

The pardon is part of a broader story about how policy and regulation are shifting around crypto.

A New Regulatory Tone

The act of pardoning a high-profile crypto executive suggests that a future regulatory regime may lean toward innovation-friendly oversight rather than purely enforcement-driven crackdowns. That could mean:

Accelerated approvals of regulated crypto products (ETFs, tokenised assets)

Less adversarial regulatory rhetoric and more collaborative frameworks

Stronger incentives for exchanges and token projects to align with compliance and transparency

Risk Remains

Despite the positive tone, the event does not eliminate all risks. Key questions remain:

Will enforcement resources shift to other actors or areas (e.g., DeFi, unregistered tokens)?

Will countries coordinate cross-border regulation of stablecoins, token issuance and crypto-exchanges?

How will institutional interest and retail speculation interplay under this new regime?

Retail investors should keep a clear view: regulatory “tailwinds” may be evolving, but tail-risk from policy missteps remains.

4. Macro & Institutional Drivers in the Wake of the Pardon

Institutional Confidence

With this regulatory milestone, institutions may feel more comfortable increasing allocations to crypto-assets and platforms they had previously viewed as too regulatory-risky.

For example:

Crypto funds and ETFs could see increased inflows as barriers to participation decline

Large funds may start allocating more to platforms like Binance if they believe regulatory risks have diminished

Retail investors may use this as a signal to reassess core crypto holdings and infrastructure exposure.

Macro Risk Factors

Crypto remains sensitive to macroeconomic forces—interest rates, inflation, global risk sentiment. Even large-scale regulatory improvements do not negate these fundamentals. The broader picture includes:

Interest rate policies: Lower rates may fuel risk asset inflows into crypto

Geopolitical risk: Geopolitical shocks can still gatekeep upside

Liquidity and capital flows: Institutional access means larger pools of capital may move into/out of crypto more quickly than in the past

Hence, the pardon should be viewed as one important piece of many influences shaping the market.

5. What Retail Investors Should Watch & Do

Key Metrics to Monitor

Exchange listings and U.S. registration status: Does Binance or other major platforms resume U.S. operations, list more tokens, or partner with U.S. banks?

Token-fund performance: Does BNB or other platform-tokens see improved utility or institutional use cases?

Fund inflows / outflows: Are new crypto investment products (ETFs, trusts) gaining momentum, especially after regulatory improvements?

Regulatory statements and enforcement actions: Even with the pardon, regulators may pivot to other areas—stablecoins, DeFi, token governance.

Macro signals: Watch interest rates, risk sentiment, global liquidity conditions—they still heavily influence crypto.

Smart Actions for Retail Investors

Stick to core exposures and high-quality platforms: This is a moment to tilt portfolios toward infrastructure and regulated entities rather than speculative “fly by night” projects.

Don’t chase hype: While regulatory relief is positive, it’s not a guarantee of returns. Evaluate projects on fundamentals.

Maintain diversification and risk control: Even as institutional comfort grows, crypto remains volatile. Treat it as part of a balanced portfolio.

Educate yourself on regulatory changes: The legal landscape is evolving quickly—being aware of compliance, exchange status, asset classification helps navigate risk.

Be patient: Institutional and regulatory shifts often play out over quarters or years, not days. Short-term performance may lag the structural changes.

6. SCN Editorial Outlook

The pardon of Changpeng Zhao by President Trump is arguably one of the strongest signals yet that the crypto industry may be entering an era of regulatory integration rather than confrontation. For retail investors, this suggests a slightly more favourable environment—but also a shift in how value is created and captured within crypto.

Gone are the days when extreme speculation alone carried the day. Moving forward, the winners may be those projects and platforms with:

Transparent governance and compliance frameworks

Institutional access and regulated product offerings

Real-world utility beyond pure trading hype

Strategic partnerships with regulated financial infrastructure

That doesn’t mean explosive returns are off the table—but it does mean the risk/reward profile is evolving. Crypto assets may increasingly behave more like other regulated alternative investments rather than purely speculative assets. Volatility may remain, but the nature of that volatility may change.

In practical terms, retail investors should adjust their mindset from “wild frontier” to “emerging asset class.” With that mindset:

Focus on fundamentals and regulatory alignment

Position for the medium to long term (3-10 years)

Set realistic expectations: innovation continues, but so does maturation

Monitor structural developments (regulation, institutional flows, infrastructure) in addition to market price action

At SCN, we believe this moment may mark a turning point. The pardon is symbolic—but when combined with the wave of ETF approvals, institutional involvement, and regulatory maturation, it may move the crypto market into a new phase. Staying informed, cautious and strategically positioned will serve retail investors well during this transition.

Disclosure: This article is for informational purposes only and does not constitute investment advice. Cryptocurrencies carry high risk—including volatility, regulatory uncertainty, and potential for loss. Retail investors should conduct their own research or consult a qualified advisor before making investment decisions.

© 2025 SmallCap Network. All rights reserved.

?