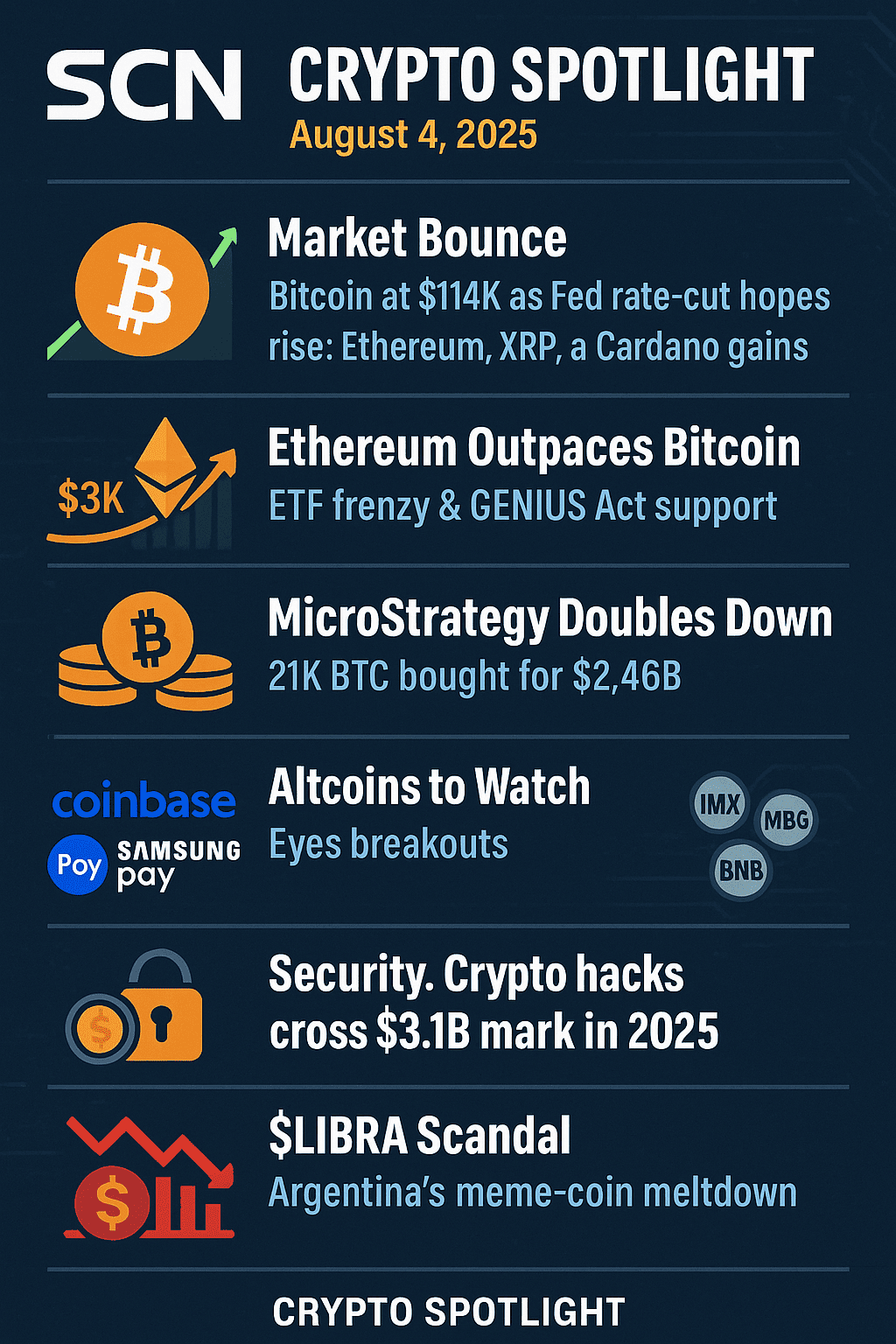

Crypto Heats Up: Bitcoin Breaks $114K, Ethereum Surges, and Scandals Shake the Market

1. Market Bounce: Bitcoin at $114K as Fed Rate-Cut Hopes Rise

Stock markets in the U.S. surged amid strong odds that the Federal Reserve will cut interest rates in September. That optimism spilled into crypto, pushing Bitcoin into the mid‑$114,000 zone and fueling up to 8% gains in Ethereum, XRP, and Cardano.The Times+1

2. Ethereum Outpaces Bitcoin: ETF Frenzy & GENIUS Act Support

Ethereum has rallied ~54% over the last month, outpacing Bitcoin’s ~10% gain, driven by massive institutional interest and regulatory momentum. The GENIUS Act, now law, has established clearer stablecoin rules—which primarily benefit Ethereum’s ecosystem given most stablecoins reside on its network. Big names like BlackRock, Fidelity, and Grayscalelaunched spot ETH ETFs, pushing trading volumes past $123B.Business Insider

3. MicroStrategy Doubles Down: 21K BTC Bought for $2.46B

MicroStrategy (now “Strategy”) made headlines by acquiring 21,021 BTC between July 28 and August 3, spending about $2.46 billion, at an average price near $117,256 per coin. The firm now holds over 628,000 BTC, valued at roughly $72.5B, reinforcing Bitcoin as a treasury asset.CoinDCX+15Barron’s+15Business Insider+15

4. Coinbase Q2 Woes, Samsung Pay Integration Boost

Coinbase delivered a mixed earnings report: revenue slid 26% YoY, operating expenses rose 15%, and the stock fell 17%. Analysts remain divided—some bullish, others cautious about retail trading levels. Parallelly, Coinbase rolled out Samsung Pay integration in the U.S. and Canada, enabling Galaxy users to buy and manage crypto seamlessly.Barron’s+1

5. Altcoins to Watch: IMX, MBG & BNB Eye Breakouts

Market eyes are on IMX, MBG, and BNB. IMX sits near $0.50, facing support at $0.497. MBG trades at ~$2.45, with an upside target of $3.09. BNB is recovering toward $793, but needs to hold above $766 to sustain gains.BeInCrypto+1

6. Security: Crypto Hacks Cross $3.1B Mark in 2025

Mid through the year, crypto-related losses surpassed $3.1 billion, driven largely by breaches, smart-contract flaws, and North Korean-linked cyber activity, per recent Web3 security reports.jdsupra.com+2ivey.uwo.ca+2

7. $LIBRA Scandal: Argentina’s Meme-Coin Meltdown

Argentina’s President Javier Milei promoted a meme token named $LIBRA, which soared then collapsed by 85%, triggering accusations of fraud and “rug pull.” Over 100 criminal complaints were filed as investigations began into investors’ losses exceeding $250 million.Wikipedia

Why SCN Readers Should Care

SCN readers know the edge lies in understanding macro catalysts, compliance trends like the GENIUS Act, and watching strategic actors such as MicroStrategy. Whether you’re holding, flipping, or building, knowing where institutions and regulators are moving can inform your next trade or investment.

SCN Takeaways:

Macro sentiment is in your favor: rate‑cut optimism is real.

Ethereum dominance is accelerating thanks to ETFs and stablecoin clarity.

If you’re long on Bitcoin, MicroStrategy’s massive buy‑in is a bullish anchor.

Regulatory clarity equals opportunity, especially for projects compliant with new stablecoin rules.

Security remains critical: hack losses are a reminder it pays to audit and secure.

Would you like SCN-style charts, altcoin deep-dives, or a tailored sector spotlight next? Let me know — SCN always delivers unique edge.

Join our community to participate in comments, rate stocks, receive daily updates, and more.

SIMILAR ARTICLES

?