Altcoin Spree Halts with $500M Liquidated, Bitcoin Dominance Climbs

Major tokens saw mixed fortunes in the past 24 hours – Bitcoin and Ether retreated from recent highs, Binance Coin notched a new record, and smaller altcoins went on a rollercoaster. A mid-week altcoin sell-off triggered over $500 million in liquidations, pushing Bitcoin’s market dominance back above 60%coindesk.comcoindesk.com. Traders are now weighing bullish ETF news against a backdrop of whale moves and macro uncertainty in an increasingly fragile market.

Bitcoin and Ethereum Retreat from Highs

Bitcoin (BTC) continues to struggle with the $120,000 ceiling. After briefly topping $120K earlier, BTC quickly lost momentum amid sell pressurecointelegraph.com and slid about 2% intraday, dipping to the $117,500 zone to “grab” liquiditycointelegraph.com. As of Wednesday afternoon, Bitcoin hovered near $118K, roughly flat to down ~0.3% over 24 hoursbinance.com. Analysts note that BTC remains range-bound between $116K support and $120K resistance – a choppy holding pattern that has persisted since its record high of ~$123K on July 14coindesk.com. Technical signals are turning cautious: the MACD indicator is hinting at a bearish momentum shift, even as Bitcoin’s uptrend from June lows stays intact for nowcoindesk.com. In short, bulls have yet to secure a decisive breakout, and a pullback to test lower support levels (potentially $113K) is on traders’ radar if the $116K floor crackscointelegraph.com.

Ethereum (ETH) is likewise in consolidation mode. Ether traded around $3,600 Wednesday, down a couple percent after a strong run-up in recent weekscoindesk.com. It touched highs near $3,850 earlier this week but has since eased off, with widening Bollinger Bands and an overbought RSI >70 signaling that volatility spiked and a “breather” is duecoindesk.comcoindesk.com. ETH’s short-term support around $3,470 will be key; a drop below that could accelerate an altcoin market sell-off, whereas holding above it could flip prior resistance into supportcoindesk.comcoindesk.com. Notably, institutional demand for Ethereum remains robust, as evidenced by massive inflows into newly launched spot ETH ETFs (over $533 million in a single day, part of a 13-day streak that added more than $4 billion of ETH exposure)cointelegraph.comcointelegraph.com. This suggests big players are accumulating ETH even as price consolidates, a dynamic that could limit downside for now.

Altcoin Season Cools Off Abruptly

Just days ago, traders were heralding an “altcoin season” as many smaller-cap tokens surged. Binance Coin (BNB) in particular stole the spotlight by soaring to a new all-time high around $804binance.com, briefly leapfrogging Solana in market cap as investor enthusiasm for majors beyond BTC/ETH grew. Early Wednesday, the market’s top gainers list was dominated by lesser-known names: Flare (FLR) jumped 21%, an NFT-themed token Pudgy Penguins (PENGU) spiked 18% with over $2.7 billion volume, and Worldcoin (WLD) – the recently launched ID-focused token – climbed nearly 9%analyticsinsight.netanalyticsinsight.net. Even DeFi names got a boost: PancakeSwap (CAKE) and Curve (CRV) rallied 7–8% on renewed interest in decentralized finance protocolsanalyticsinsight.netanalyticsinsight.net. Altcoins were clearly in vogue, outperforming Bitcoin and Ether earlier in the day as traders rotated into high-beta betscoindesk.comcoindesk.com.

That euphoria proved short-lived. By Wednesday afternoon, the altcoin surge met a harsh reversal, with several major alts tumbling sharply. Solana (SOL), which had been riding a multi-week uptrend, plunged ~7% on the daycoindesk.com, falling back under $190 after reaching as high as $206 in the prior session. Ripple’s XRP dropped about 5–7%, breaking below its July uptrend line as bullish momentum fadedcoindesk.comcoindesk.com. Toncoin (TON) was hit even harder, losing 11% in 24 hourscoindesk.com. Even the meme-coins weren’t spared: Shiba Inu (SHIB) sank roughly 7% amid an onslaught of sell orders totaling 4.33 trillion SHIB tokens, while its rival Dogecoin (DOGE) slid about 8.5%coindesk.comcoindesk.com. This broad altcoin pullback effectively pumped the brakes on “altseason”, at least for now – a reality check that came “before it ever really got started,” as one analyst wryly notedcoindesk.com.

$200M Liquidations and a Spike in Bitcoin Dominance

One immediate consequence of the altcoin sell-off was a cascade of leveraged long liquidations. As thinner liquidity alt markets recoiled, over $200 million worth of long positions were wiped out on Wednesdaycoindesk.comcoindesk.com. Ethereum longs bore the brunt (~$43M liquidated) and XRP longs about $32M, as highly leveraged traders got caught offsidecoindesk.comcoindesk.com. In total, across all cryptocurrencies, more than 176,000 traders saw positions auto-deleveraged in the past 24 hours, amounting to over $500 million in liquidations when including Bitcoin and otherscointelegraph.comcointelegraph.com. This kind of flush highlights how “frothy” leverage had become in recent days: open interest on top altcoin futures hit record highs (OI across four leading alts topped $40B this week)cointelegraph.com, leaving the market “susceptible to sharp volatility” when sentiment shiftedcointelegraph.com. The mid-week shakeout forcefully reduced some of that excess leverage – a painful lesson for those chasing quick gains in speculative alts.

For Bitcoin holders, however, this dynamic has a silver lining. Bitcoin’s dominance – its share of total crypto market cap – jumped back above 60% amid the altcoin routcoindesk.com. BTC largely held its value while alts sank, underscoring a typical pattern: in times of stress, money rotates back into the relative safety of Bitcoin. The global crypto market cap is roughly $3.9 trillion, up about 0.5% over the last daybinance.com, but that modest rise masks significant churn underneath. Essentially, Bitcoin stabilized the ship while higher-risk tokens seesawed. Many traders are now watching if capital that fled alts will stay on the sidelines or eventually cycle back into majors like BTC and ETH. If Ethereum can defend key support (around $3.47K as noted)coindesk.com and Bitcoin holds above $116K, confidence in another leg of the rally could return – but a failure at these levels might extend the altcoin pain.

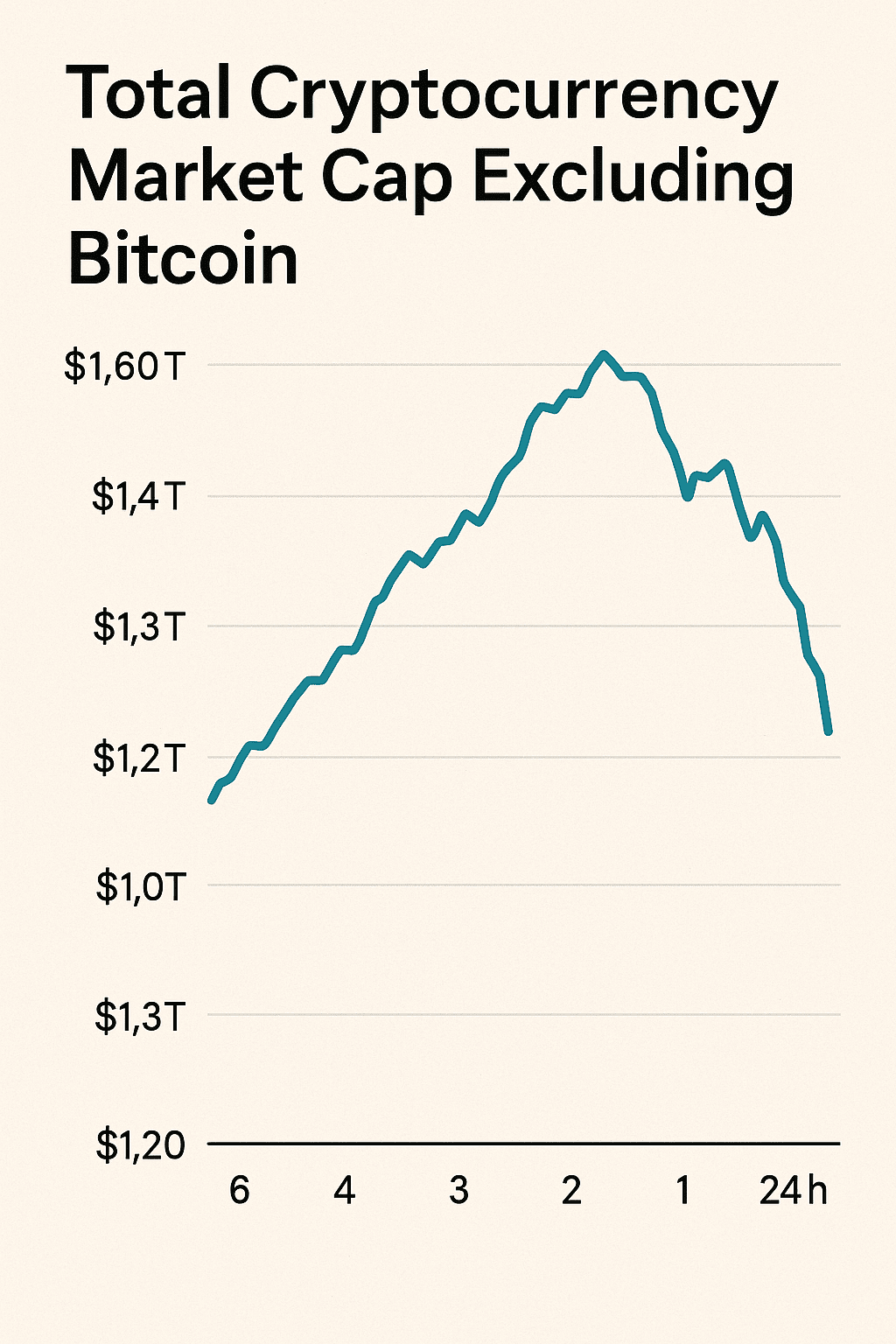

Chart: Total cryptocurrency market cap excluding Bitcoin over the past week. A sharp mid-week drop in altcoin valuations ended a multi-day uptrend, as Bitcoin’s dominance climbed in the face of altcoin volatilitycoindesk.comcoindesk.com.

Whales Stir as XRP Moves and BNB Cools

Amid the volatility, whale movements are catching traders’ attention. This week saw a series of massive XRP transfers that have raised eyebrows. Blockchain sleuths tracked 200 million XRP (worth over $700 million) shifting from an older wallet into a new address – in fact, the third such huge transfer in a weekbinance.combinance.com. Notably, the sender in all cases appears to be Ripple itself, sparking speculation that the company (which holds significant XRP reserves) might be reallocating funds or preparing to distribute tokensbinance.combinance.com. Observers debated whether this represents profit-taking by insiders or positioning ahead of some development. Ripple’s moves came just as XRP’s price hit a local peak of $3.65 late last week and then pulled back ~5% to the mid-$3.40sbinance.com. Some analysts downplayed the transfers as internal shuffling, but the timing – corresponding with XRP nearly reclaiming its 2018 all-time high – has injected a dose of intrigue into the market narrative.

Elsewhere, Binance Coin (BNB), which was on a tear to new highs, showed signs of cooling off post-ATH. After cracking $800, BNB slipped back into the high-$700s, trading around $792 (+4.2% on the day)binance.com. Profit-taking is to be expected after such a vertical move, but traders are watching whether BNB’s strength signals a broader rotation back into exchange tokens or if it was an isolated surge. It’s worth noting that BNB’s spike was accompanied by over $3.2 billion in 24h trading volumeanalyticsinsight.net, reflecting unusually high interest – a level of activity that could either mark a blow-off top or a prelude to further upside if momentum continues. With Binance facing its share of regulatory scrutiny globally, BNB’s climb to record territory struck some as counterintuitive. The price action, however, shows that when altcoin season speculation heats up, even fundamentally controversial tokens can catch a bid. Now that the wider alt rally has paused, BNB may trade more on its own news and fundamentals again. For instance, any updates on Binance’s legal standing or ecosystem developments could swing trader sentiment on BNB quickly, so this is one to watch closely.

DeFi, Meme Coins and AI Tokens: Mixed Bag of Narratives

This week’s market rotation also highlighted the ever-shifting narratives driving crypto. During the upswing, DeFi tokens staged a mini-resurgence. PancakeSwap’s CAKE and Curve’s CRV – key tokens in the decentralized exchange and stablecoin liquidity sectors – both notched high-single-digit gains in 24 hoursanalyticsinsight.netanalyticsinsight.net. Volume in these tokens was robust, suggesting that traders are reawakening to DeFi opportunities, possibly lured by protocol revenues or upcoming product launches. Even Pendle (PENDLE), a DeFi yield token, jumped ~7% with strong turnover, hinting at a broader bid in yield-generating crypto assets. This DeFi uptick comes as crypto lending and trading protocols attempt comebacks from last year’s downturn – some see the nascent rally as a sign that capital is tiptoeing back into DeFi, anticipating that if the overall market recovers, undervalued DeFi projects could outperform.

The meme coin sector, on the other hand, flashed warning signs. The sharp drops in SHIB and DOGE mentioned earlier underscore that these speculative assets can turn on a dime. Shiba Inu’s 7% fall was accompanied by extreme trading volumes (4.33 trillion SHIB tokens changed hands in 24h)coindesk.comcoindesk.com, indicating heavy profit-taking by whales or possibly a coordinated dump. Yet interestingly, SHIB still slightly outperformed DOGE over the same periodcoindesk.com, perhaps because SHIB’s ecosystem has been expanding (with DeFi and metaverse plans) whereas Dogecoin remains a purely transactional meme coin. Regardless, the meme coin slump during Wednesday’s rout suggests that when risk appetite diminishes, these highly speculative tokens are the first to get hit. Traders playing in this arena are reminded that while meme coins can deliver explosive gains, they carry equally outsized downside risk if the broader market wavers.

Another buzzword making rounds is “AI tokens.” Over the past month, there’s been growing chatter about crypto projects with artificial intelligence angles, as investors hunt for the next thematic play. A few days ago, for example, NEAR Protocol jumped ~12% on a wave of enthusiasm linking it to AI narrativescoindesk.comcoindesk.com, even though NEAR is a general-purpose blockchain. The idea is that blockchain-based AI and data projects (such as certain decentralized AI marketplaces or protocols enabling machine learning on-chain) might see outsized interest in a tech-forward bull cycle. Indeed, analysts described the recent altcoin rotation as being led in part by “AI-focused crypto projects” drawing inflows as traders rotated out of large-capscoindesk.comcoindesk.com. It’s a highly speculative trend – many so-called AI tokens are still very early-stage – but it showcases how quickly a narrative can catch fire in crypto. At this point, the AI token theme remains more of a watch-and-see narrative; Wednesday’s pullback didn’t single out AI tokens specifically (they corrected alongside everything else). However, if risk appetite returns, don’t be surprised if this sector attempts another rally. Savvy traders will keep an eye on whether any AI-related crypto announcements or partnerships emerge, as those could catalyze short-term pops. Caveat: As one analyst warned, “AI tokens are still highly speculative… investors should look for projects with real adoption, not just hype”fameex.com.

ETF Mania and Institutional Inflows Continue

A countervailing force to all the volatility is the drumbeat of institutional adoption news, especially around crypto ETFs. In fact, positive developments on this front may have helped buoy market sentiment earlier in the week. The biggest headline was that the U.S. SEC for the first time approved a broad crypto index fund to ETF conversion – namely, Bitwise’s 10 Crypto Index Fund, which holds a basket of top assets (BTC, ETH, and others)coinness.com. This marks a significant regulatory milestone, effectively green-lighting a diversified crypto index ETF product for U.S. investors. Such approval was almost unthinkable a year ago, and traders view it as a sign that regulators are slowly warming to crypto beyond just Bitcoin. Bitwise’s index ETF could pave the way for more complex crypto exchange-traded products, and it comes on the heels of multiple spot Bitcoin ETF applications by major players still pending. In short, the ETF dominoes are starting to fall, offering a new on-ramp for institutional capital.

Ethereum in particular is seeing historic institutional inflows thanks to ETFs abroad. Spot Ether ETFs saw record-breaking inflows this month – with one day alone ($533.8M on July 22) pushing the 13-day cumulative inflow above $4 billioncointelegraph.comcointelegraph.com. Total assets in Ether investment products have now swelled to nearly $20B, about 4.4% of ETH’s market capcointelegraph.com. BlackRock’s Ethereum Trust led the charge, now holding over $10B of ETHcointelegraph.com. This rising institutional appetite for ETH is noteworthy; as one analyst pointed out, investor allocations to Ethereum still lag relative to its share of crypto market cap, so there’s room for catch-upcointelegraph.com. If that rotation accelerates, it could be a tailwind for ETH price even as retail trading cools. It’s also telling that while Ethereum products added money, spot Bitcoin ETFs actually saw net outflows (~$68M) in the same periodcointelegraph.com – perhaps reflecting some rotation from BTC to ETH among institutional players looking for higher growth potential.

Other ETF-related news reinforced the theme. 21Shares filed for a new Ethereum staking yield ETF (dubbed “ONDO”), indicating innovation in crypto investment offerings continuesbinance.combinance.com. Meanwhile, a Solana Staking (SSK) ETF just surpassed $100M in assets under management, a sign that Wall Street is even exploring yields from staking on high-performance altcoinsbinance.com. Each of these developments contributes to a narrative that crypto is becoming more integrated with traditional finance. For traders, the practical effect is twofold: increased institutional participation can improve liquidity and price stability over time, but it can also tie crypto more closely to macro factors (as big funds treat Bitcoin/ETH like part of their broader portfolios). In any case, the steady drumbeat of ETF and regulatory news this week – including a notable congressional move, with U.S. lawmakers introducing a new Digital Asset Market Structure bill to clarify crypto regulationsbinance.com – provides a backdrop of long-term optimism. Despite short-term gyrations, the infrastructure for mainstream crypto adoption is clearly being built out.

Macro Clouds: Fed Pause, Inflation and Trade Policy

Looming beyond the crypto-specific drivers are the macroeconomic and policy signals that continue to sway investor sentiment. On the monetary front, the latest word from the U.S. Federal Reserve gave a mixed message. Fed Chair Jerome Powell indicated no interest rate hike this round, opting to hold rates steadybinance.com. Initially, crypto markets reacted positively to the pause, with Bitcoin actually popping above $120K in the hours around the announcement before that move fadedcointelegraph.com. The relief was short-lived because Powell’s tone came with a dose of caution – inflation is “not under control yet,” and the Fed left the door open for future tightening if prices don’t coolbinance.com. This reminded traders that uncertainty remains high. Indeed, Bitcoin’s slight slip after the Fed news demonstrated how sensitive the crypto market is to central bank signalsbinance.com. In the near term, a paused Fed is a double-edged sword: it avoids immediate pressure from rising rates (good for risk assets), but it may also reflect concerns about economic growth and inflation that could dampen risk appetite longer-term. As one crypto commentator put it, “Every Jerome Powell statement now matters more than ever” for Bitcoinbinance.com.

Geopolitics and trade policy are also in play. A major U.S.–Japan trade agreement was finalized this week, which has implications for global markets. The deal maintained hefty 50% tariffs on steel but cut tariffs on autos to 15%, and included a headline-grabbing promise of $550 billion in Japanese investment into the U.S.binance.combinance.com. Reactions were mixed: some analysts hailed the reduction of trade uncertainty (which could stabilize business planningand support markets)binance.com, while others warned that keeping steep steel tariffs might hurt Japan’s economy and even pressure the yenbinance.com. For crypto traders, such macro developments matter insofar as they influence the overall risk environment. A more amicable trade outlook can boost equities and risk assets, potentially spilling over to crypto. Conversely, if tariffs add to inflation or slow growth (as Goldman Sachs projected – they revised U.S. GDP down to 1% for 2025 due to tariff impacts)binance.com, investors might grow more cautious. Notably, Goldman’s economists see tariffs adding ~1.7% to core inflation over the next 2-3 yearsbinance.com, which could complicate the Fed’s job and keep macro uncertainty simmering.

On balance, the macro picture presents cross-currents for crypto. There’s a case to be made that ongoing inflation and low growth increase crypto’s appeal as an alternative asset (especially Bitcoin’s narrative as digital gold or an inflation hedge). Yet in the immediate term, tight financial conditions and geopolitical unknowns can sap liquidity from all risk markets, crypto included. Traders in the crypto space are thus increasingly monitoring economic indicators, central bank signals, and even currency moves (e.g. a weakening yen or dollar strength) as part of their decision-making matrix. The past 24 hours underscored this interplay: crypto didn’t move in isolation – it reacted to Fed news, and it may react to upcoming macro data (like inflation reports or employment numbers) in the days ahead.

Conclusion: Cautious Optimism Amid Volatility

The last day has been a microcosm of the crypto market’s current state – a tug-of-war between bullish catalysts and cautionary signals. On one hand, market fundamentals and news flow offer reasons for optimism: big institutional money is flowing into crypto via ETFs at unprecedented rates, regulatory barriers are slowly coming down, and flagship assets like Bitcoin and Ethereum remain near multi-month highs. Even the recent altcoin excitement, though dented, shows that animal spirits are alive and well; capital is willing to chase transformative narratives (whether DeFi, AI, or others) when conditions are right. On the other hand, the swift altcoin pullback and liquidation wave are a stark reminder of this market’s fragility. Excess leverage and thin liquidity can lead to violent swings, and traders can’t afford complacency at these elevated price levels.

For crypto traders navigating this landscape, an opinionated take would be: cautious optimism. The medium-term trend (past months) has been up, but risk management is paramount in the short term. Watching key technical levels – such as Bitcoin’s range limits and Ethereum’s support around $3.47K – is crucial. A decisive break below could signal a deeper correction (and perhaps a better buying opportunity later), whereas a strong bounce might mark the end of this healthy shakeout. In the very near term, focus is shifting back to Bitcoin and Ether as bellwethers; expect BTC’s dominance to remain high if uncertainty persistscoindesk.com. That said, if confidence returns quickly (helped by, say, a successful defense of support or a new positive news catalyst), the altcoin party could resume just as fast – with sidelined cash ready to pounce on beaten-down high-beta plays.

Traders should also keep one eye on the macro and policy tape. Crypto no longer operates in a vacuum; a surprise rate move, regulatory announcement, or macro data point can spark or spoil momentum. The coming days will tell whether Wednesday’s dip was merely a pit stop for the 2025 crypto rally or the start of a larger trend reversal. Given the opportunity-rich but volatile environment, savvy traders are likely trimming some leverage, hedging where prudent, but staying ready to “buy the dip” on strong assets if panic were to overshoot. In summary, the past 24 hours delivered both a warning and a reassurance: the crypto market’s potential remains vast, but so are its swings. Proceed accordingly, with both conviction and caution as your guides.

Sources: Binance Market Updatebinance.combinance.com; CoinDesk Market Analysiscoindesk.comcoindesk.com; CoinDesk News – Altcoin Sell-offcoindesk.comcoindesk.com; Cointelegraph Market Updatecointelegraph.comcointelegraph.com; Moneycontrol Crypto Livemoneycontrol.commoneycontrol.com; Analytics Insight Altcoin Reportanalyticsinsight.netanalyticsinsight.net; U.Today Whale Alertbinance.combinance.com; Binance News (Fed and Trade)binance.combinance.com; Cointelegraph Ethereum ETF Reportcointelegraph.comcointelegraph.com.

Join our community to participate in comments, rate stocks, receive daily updates, and more.

SIMILAR ARTICLES

?