North American Stocks: Small Caps, Tech Strength, Macro Clarity

Small-Caps Continue To Outperform: Russell 2000 rallied 7.5% in August

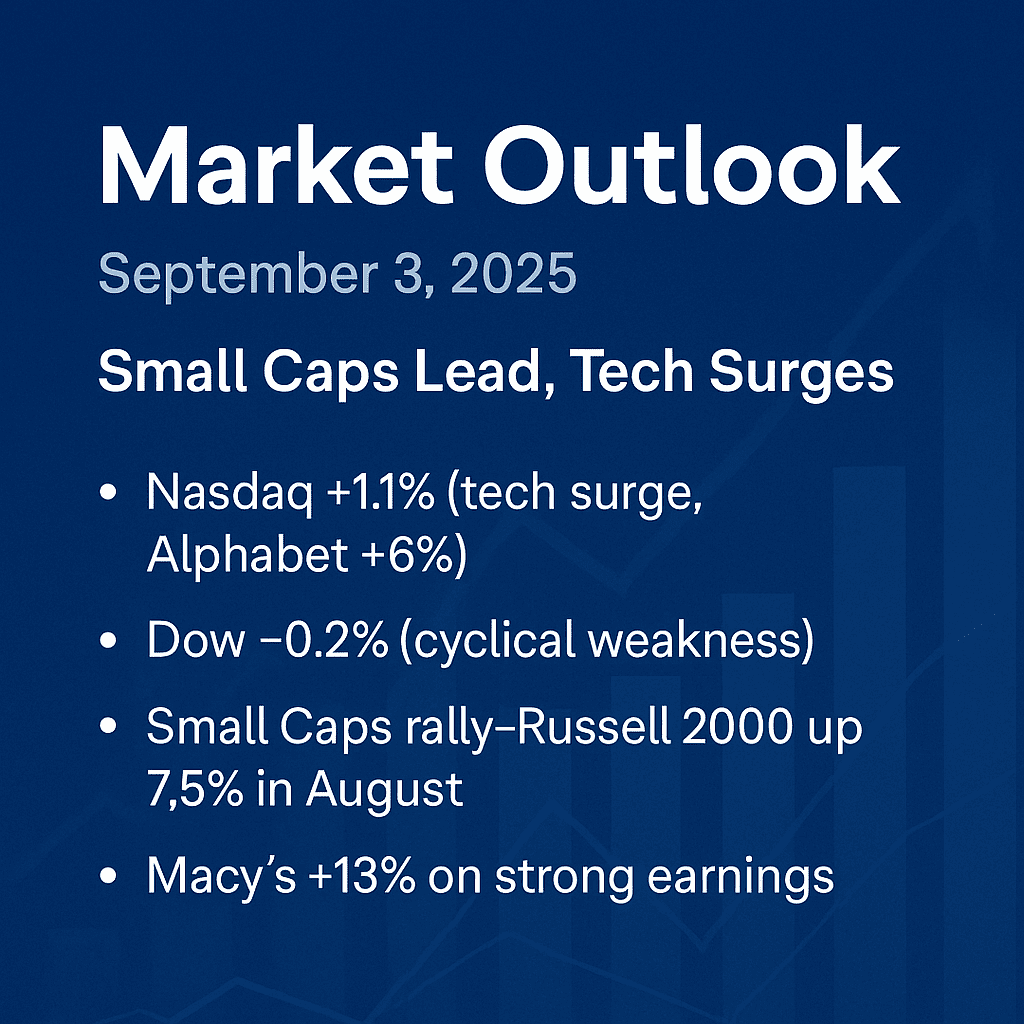

U.S. equity markets displayed mixed performance on September 3, 2025. The Nasdaq led gains with a 1.1% rise, buoyed by tech strength, while the S&P 500 edged up 0.4%. In contrast, the Dow Jones Industrial Average slipped 0.2% as investors turned cautious on cyclical sectors.

Market Outlook – September 3, 2025

North American Stocks: Small Caps, Tech Strength, Macro Clarity

Market Snapshot: Mixed Signals and Sector Divergence

U.S. equity markets displayed mixed performance on September 3, 2025. The Nasdaq led gains with a 1.1% rise, buoyed by tech strength, while the S&P 500 edged up 0.4%. In contrast, the Dow Jones Industrial Average slipped 0.2% as investors turned cautious on cyclical sectors.Investors

In pre-market futures, both S&P and Nasdaq are higher—Nasdaq up approximately 0.7%, and S&P gaining around 0.5%. The Dow remains largely flat.InvestopediaInvestors

Tech Surge Anchored by Antitrust Ruling

Alphabet soared following a favorable court ruling—the company will no longer be forced to divest its Chrome browser or terminate key partnerships, though it must end certain exclusive search contracts and sharing policies. Apple also rallied (~3–4%) as its default search arrangement with Google remains intact.Yahoo Finance+5Investors+5Barron’s+5

Facebook parent Meta made headlines by hiring Jian Zhang, a key AI robotics researcher from Apple—underscoring the intensifying talent war in AI development.Investopedia

Earnings Spotlight: Retail and Tech in Focus

Earnings continue to drive volatility. Macy’s stunned the streets with a 12–13% jump thanks to better-than-expected results and a raised outlook. Other notable performers include Campbell’s (up ~4%) and HealthEquity (up ~5%) on solid reports. Zscaler, despite beating expectations, slid on cautious forward guidance, while Dollar Tree dropped nearly 4% with a weak outlook.Investors+1

Macro Observations: Jobs, Fed, and Tariff Uncertainty

July’s JOLTS data revealed 7.18 million job openings, lower than the 7.38 million forecast, hinting at cooling labor demand. Factory orders slumped 1.3% in July—a second straight month of decline.Investors+1

Fed Governor Christopher Waller left the door open for a September rate cut, while Treasury Secretary Scott Bessent initiated the search for the next Fed Chair.Investors

Geopolitical risk remains elevated: renewed concerns around Trump-era tariffs are resurfacing on Wall Street.Investors

Small Caps Shine Amid Big Cap Volatility

Small-cap equities continue to outperform, riding the wave of rate-cut optimism and value rotation. In August, interest-rate-sensitive small-cap stocks surged 7.5%, marking their strongest month relative to the S&P 500 in nine months.edwardjones.ca+2Schwab Brokerage+2

2Q25 small-cap performance was equally impressive: the Russell 2000 gained 8.5%, with micro-caps spiking 15.5%—outpacing both mid- and large-cap indices.royceinvest.com

These gains illustrate small caps’ increasing appeal for investors seeking growth beyond mega-cap tech giants.

Sector Snapshot: Retail, Biotech, Tech & Beyond

Retail: Macy’s stood out with massive upside on strong same-store sales—its rally could signal broader confidence in discretionary consumption amid easing inflation.Barron’s

Tech & AI: Higher futures and earnings strength are amplified by the antitrust ruling and Meta’s executive hire—underscoring tech’s continued dominance.Barron’sInvestopedia

Financials & Industrials: Downbeat outlooks from Dollar Tree and cautious guidance from others suggest vulnerability remains in some cyclical staples.InvestorsBarron’s

Gold & Defensive Assets: Amid lingering tariff and inflation uncertainty, investors are creeping into gold and defensive sectors, although more clarity is needed.InvestopediaInvestors

What’s Ahead: Key Catalysts to Monitor

| Driver | Market Impact |

| JOLTS, Factory Orders | Additional soft data could reinforce a rate cut narrative |

| Fed Chair Search | New leadership could shift policy tone and market expectations |

| Earnings Cycle | Reports from big tech, consumer goods, and financial firms remain pivotal |

| Tariffs & Trade Risks | Any escalation could reverse recent positive moves |

| Small Cap Performance | Continued strength may signal broader market participation |

Investor Sentiment: Balanced Optimism

Traders are embracing a “barbell strategy”: Large-cap tech offers downside protection while small-cap equities constitute elevated upside potential. Small caps today reflect both value and growth, bridging search for alpha and risk control.Investors+1edwardjones.ca+1

Institutional investors appear increasingly willing to tilt small, especially with buoyant earnings and a potential dovish pivot from the Fed.

Final Take

Today’s stock market is defined by divergence and opportunity. Tech continues to lead on favorable rulings and AI developments, while retail earnings provide intermittent lift. Macro data adds nuance to rate-cut expectations, and tariffs remain a latent risk.

Importantly, small caps are flashing leadership, buoyed by valuations, economic sensitivity, and rotation away from mega-caps. If Fed policy turns kinder, small caps may not just participate in the next bull run—they could lead it.

For investors, the message is clear: stay diversified, monitor macro cues closely, and don’t overlook the opportunity in small-cap equities—especially those with solid fundamentals and insider confidence.

Join our community to participate in comments, rate stocks, receive daily updates, and more.

SIMILAR ARTICLES

Small Cap Network

Small Cap Network

Small Cap Network

?