Investor sentiment improved markedly after weeks of uncertainty

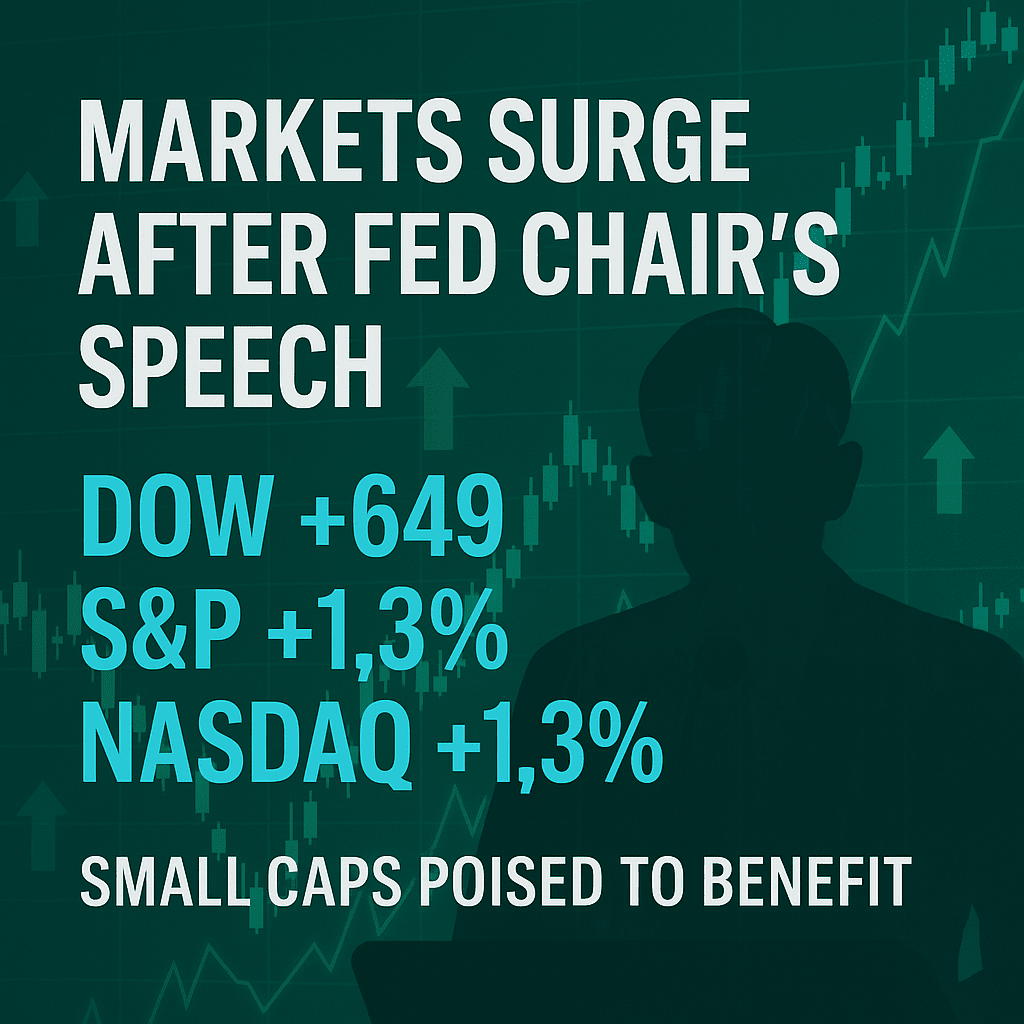

Wall Street Surges as Powell Signals Possible Rate Cuts — Small Caps Poised to Benefit

Wall Street closed sharply higher today as Federal Reserve Chair Jerome Powell delivered a carefully worded but encouraging message at the annual Jackson Hole symposium.

Wall Street Surges as Powell Signals Possible Rate Cuts — Small Caps Poised to Benefit

August 22, 2025 — SmallCap Network

Wall Street closed sharply higher today as Federal Reserve Chair Jerome Powell delivered a carefully worded but encouraging message at the annual Jackson Hole symposium. Powell noted that the “balance of risks” has shifted, suggesting the Fed may soon have room to adjust its policy stance and consider interest-rate cuts.

The market reacted swiftly. The Dow Jones Industrial Average climbed 649 points (1.4%), while both the S&P 500 and Nasdaq Composite gained 1.3%. Bond yields fell across the curve, signalling that investors are betting on a dovish pivot.

Broad Market Optimism

Investor sentiment improved markedly after weeks of uncertainty. Growth and rate-sensitive sectors, particularly technology and retail, saw outsized gains. Nvidia and Ross Stores led the charge, while financials also rebounded on easing yield pressure.

Global cues added to the upbeat tone, with European equities and Asian markets strengthening in tandem. The market’s rally highlights optimism that the Fed can navigate slowing inflation without pushing the economy into a hard landing.

Why Small Caps Could Shine

Perhaps the biggest takeaway for retail investors is the potential resurgence of small-cap and value stocks. Historically, these segments outperform during rate-cut cycles as lower borrowing costs reduce financial strain and improve growth prospects.

With many small-cap valuations trading at discounts compared to large-cap peers, Powell’s signal may unlock significant upside for investors willing to take positions in this overlooked segment of the market.

Bottom Line

Powell’s remarks at Jackson Hole didn’t set a firm timeline for rate cuts, but they did inject optimism into global markets. The Fed’s next moves will remain data-dependent, yet today’s rally illustrates how even a hint of monetary easing can energize equities. For small-cap investors, this could be the start of a meaningful re-rating cycle.

Join our community to participate in comments, rate stocks, receive daily updates, and more.

SIMILAR ARTICLES

Small Cap Network

Small Cap Network

Small Cap Network

?