North American Small-Cap Highlights

U.S. Markets Rally, Small-Caps Spark Leadership

The Russell 2000 (small‑cap benchmark) climbed around 0.8%, signaling renewed interest in smaller-cap names.

These gains were fueled by optimism around potential Federal Reserve rate cuts, following Chair Jerome Powell’s dovish remarks, along with robust earnings reports across the board.Investors+4The Wall Street Journal+4Benzinga+4MarketWatch

Market Snapshot & Momentum

Tuesday, August 26, 2025, major U.S. equity indices finished higher:

S&P Equal‑Weighted Index rose approximately 2%, outpacing large‑caps, demonstrating broad-based strength.

The Russell 2000 (small‑cap benchmark) climbed around 0.8%, signaling renewed interest in smaller-cap names.

These gains were fueled by optimism around potential Federal Reserve rate cuts, following Chair Jerome Powell’s dovish remarks, along with robust earnings reports across the board.Investors+4The Wall Street Journal+4Benzinga+4MarketWatch

Building on that momentum, Wednesday morning futures for the Dow Jones, S&P 500, and Nasdaq are modestly higher, as investors await Nvidia’s upcoming earnings report—an event poised to influence AI sector sentiment.Investors

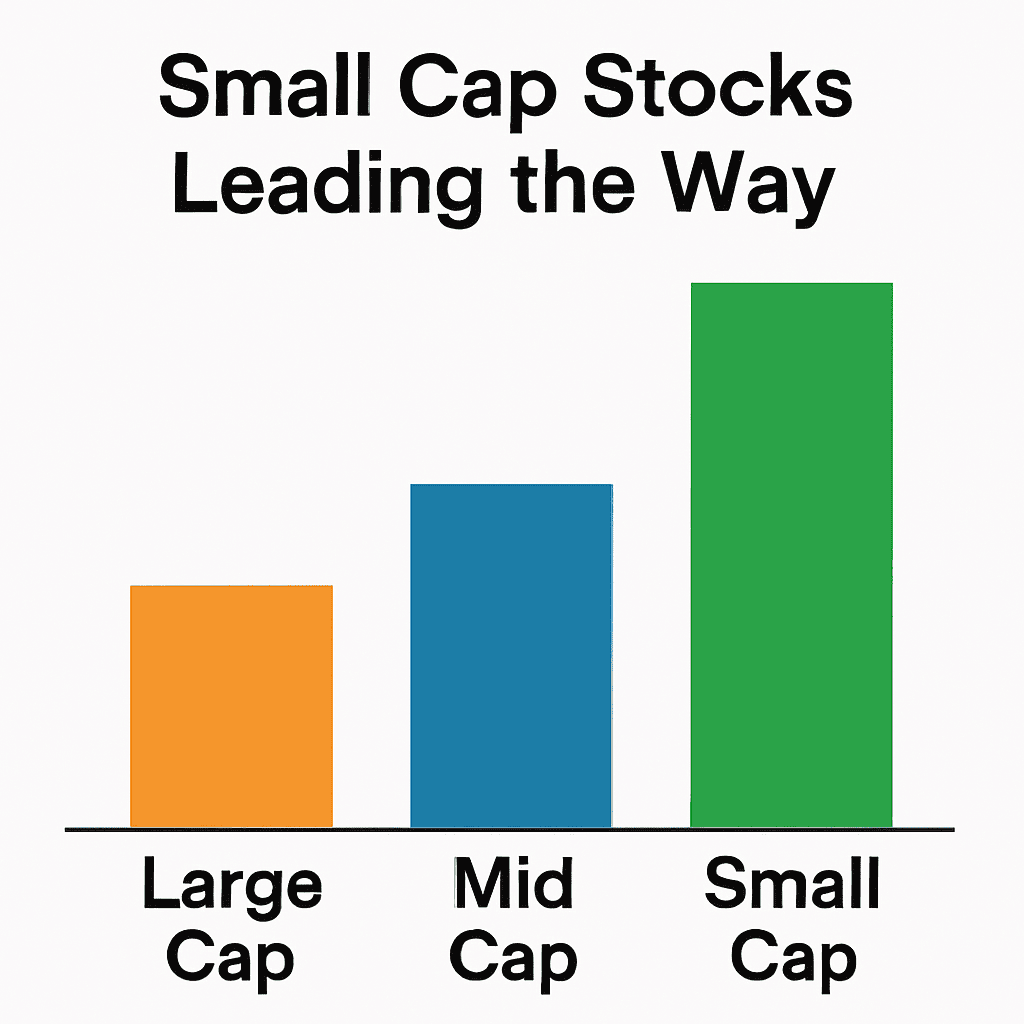

Why Small-Caps Are Catching Fire

Several key factors are contributing to small-cap strength today:

Rate Cut Expectations

Signals of a potential Fed rate cut in September have boosted small-cap appeal. The Russell 2000 surged 4% last Friday, breaking out of its prior trading range. Such moves are often driven by hopes of easier financing conditions and higher growth expectations for smaller companies.Simply Wall St+15MarketWatch+15Barron’s+15

Deep Discount & Value Play

Small-cap stocks continue to trade at a meaningful discount—some estimates suggest up to 40% cheaper than large caps, a disparity reminiscent of the post-dot-com era.Axios

Analysts from Barron’s note this pricing gap and suggest small-cap value stocks (e.g., in sectors like financials, industrials, healthcare) may outperform once the Fed eases rates.Barron’s+1

Under-Diversification Opportunity

According to Axios, small-caps—typically companies under US$2 billion—are starting to break free from long-standing underperformance versus large caps, offering diversification amid Big Tech dominance.NasdaqAxios+1

In sum, this looks like the start of a “stealth rally” in small-caps, with increasing participation as broader optimism grows.

Featured North American Small-Cap Highlights

5N Plus Inc. (OTCMKTS: FPLSF)

This company hit a 52‑week high, trading as high as US$644.15, signaling strong investor interest. While OTC-listed, such breakouts often attract attention from both retail and institutional players.MarketBeat

Hawkins Inc. (HWKN)

A key conference appearance on September 17—the Sidoti Small Cap Virtual Conference—will put Hawkins’ CEO and CFO in front of 500+ investment firms, boosting visibility and potentially valuation.Stock Titan

Broader Small-Cap Recaps

Ocean Power Technologies, Alvopetro Energy, Power Metallic Mines, and Excellon Resources are among the small-caps seeing operational developments—Excellon, for instance, expanded its private placement offering.Proactiveinvestors NA+1

These stories, though quieter, reflect ongoing activity across sectors—from energy to mining.

Sectors & Trends: Spotlight on Growth Catalysts

1. Financials & Industrials

With rate cut potential, these sectors may benefit from improved loan demand and capital access. Institutions like Evercore, ESAB, AAON, Yeti, and Advance Auto Parts are receiving renewed emphasis from active managers.Barron’s

2. Healthcare & Consumer Value Plays

As fundamentals improve and valuations remain attractive, this sector—especially underfollowed small-caps—could see inflows, especially in a rate‑cut environment.Axios

3. Energy & Materials

Companies like those in Hawkins’ and Excellon’s orbit reflect steady activity, while surging commodities or resource-related sentiment may offer tailwinds.

4. AI & Technology

Small-cap tech isn’t immune to the broader AI-driven boom. Nvidia’s forthcoming earnings report (which is likely to set direction) could spur sector-wide movements, from hardware to software small-caps.Stock Titan

Market Sentiment & Strategic Outlook

Sentiment is cautiously bullish: Rate‑cut hopes underpin optimism, but investors await confirmation through macro indicators (e.g., jobs data) and central bank messaging.Axios

Careful stock selection remains key: Though opportunities abound, smaller firms are more vulnerable to economic shocks—highlighting the importance of picking strong balance sheets and quality management teams.Axios

Diversification matters: The S&P Equal‑Weighted Index outperforming its cap-weighted peers illustrates the value of broadening beyond mega-cap tech.The Wall Street Journal

Summary Table: Quick Takeaways

| Theme | Insight |

| Small-Cap Surge | Russell 2000 gaining ground, 4% breakout last Friday |

| Valuation Gap | ~40% discount noted; small-caps ripe for upside |

| Featured Stories | 5N Plus at 52-week high; Hawkins set for investor spotlight |

| Sector Winners | Financials, healthcare, energy, AI – well-positioned going forward |

| Macro Watchpoints | Fed rate outlook, job data, earnings (esp. Nvidia) |

| Investor Approach | Remains optimistic—but grounded in selective, quality-centric picking |

Join our community to participate in comments, rate stocks, receive daily updates, and more.

SIMILAR ARTICLES

Small Cap Network

Small Cap Network

Small Cap Network

?