Potential upside for small-caps

Market Snapshot: Broad Strength, But Mixed Signals

kable session for the North American markets, investors woke to a blend of record-setting equity indices, a cautious pause ahead of a major central-bank decision, and mounting optimism around artificial-intelligence (AI)-driven earnings momentum. Here’s a full rundown of how the markets are behaving, what’s behind the moves, and – of particular interest to the small-cap space – how smaller securities are faring in the current environment.

SmallCap Network Editorial – October 28 2025

In a remarkable session for the North American markets, investors woke to a blend of record-setting equity indices, a cautious pause ahead of a major central-bank decision, and mounting optimism around artificial-intelligence (AI)-driven earnings momentum. Here’s a full rundown of how the markets are behaving, what’s behind the moves, and – of particular interest to the small-cap space – how smaller securities are faring in the current environment.

1. Market Snapshot: Broad Strength, But Mixed Signals

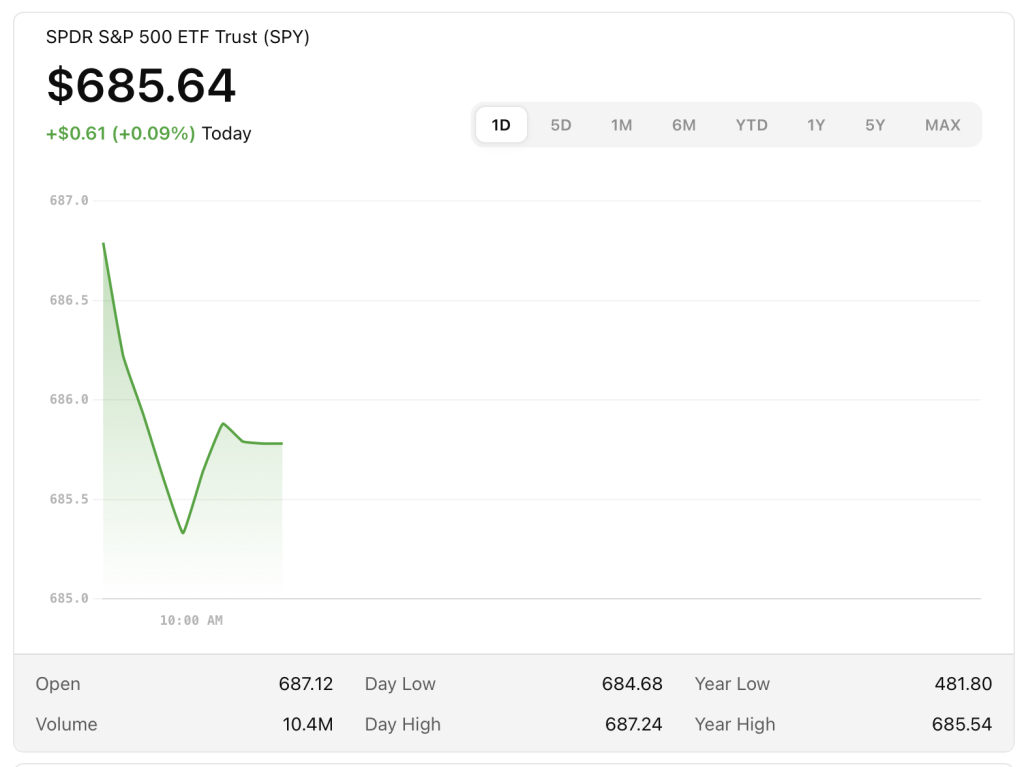

The U.S. equity market entered the day on firm footing. Broad indices — including the S&P 500, Dow Jones Industrial Average and Nasdaq Composite — recently closed at new record highs. In fact, all four major U.S. indexes (including the Russell 2000 small-cap index) achieved this feat simultaneously. Reuters+3marketwatch.com+3morningstar.com+3

For context, such a simultaneous record close across all four major indexes is rare, and history suggests that momentum often carries forward in the medium term. marketwatch.com+1

Markets are broadly pausing right now — futures are near highs but not aggressively higher, likely reflecting investor caution ahead of major earnings and central-bank moves. Reuters+2Investopedia+2

Among the drivers of strength:

Corporate earnings are generally beating expectations. From early reads, roughly 87% of companies in the S&P 500 that have reported are beating consensus. Reuters+1

The spotlight remains firmly on large tech and AI-related companies, with big-cap names pushing the market upward. bloomberg.com+1

Macro factors: The upcoming meeting of the Federal Reserve (Oct 28–29) is creating a bit of a tug-of-war between risk-on equity appetite and caution over policy.

2. Why the Rally? What’s Fueling It

A handful of themes are powering sentiment:

a) AI and megatech earnings momentum

Large technology companies continue to dominate via AI-led narratives. The market is placing a premium on companies integrating or scaling their AI capabilities, leading to outsized valuations for winners. Reuters+1

b) Anticipation of Fed policy easing

With softening economic data and inflation in focus, the Fed meeting has become a major market event. Many investors expect at least a 25 bps rate cut before year-end, and perhaps sooner. A dovish signal could spur further upside in equities, especially growth-oriented stocks. marketwatch.com+1

c) Trade and global-macro tailwinds

Improving signals from global trade (notably U.S.-China) and a declining safe-haven bid (e.g., gold) reflect a tilt toward risk assets. Gold recently hit a three-week low. Reuters+1

d) Market concentration and the “big get bigger” dynamic

Despite complaints of narrow leadership, a recent Reuters analysis highlights that U.S. market concentration is less extreme than widely believed. Meaning: while megacaps are large, the risk of over-concentration may be overstated — yet the few names still exert considerable influence. Reuters

3. Small Caps: Participation, But Underlying Nuance

Often when the large-cap part of the market is thriving, small caps either lead (in risk-on surges) or lag (when risk becomes more selective). Here’s how the small-cap sector is behaving today, and what to watch:

Current positioning:

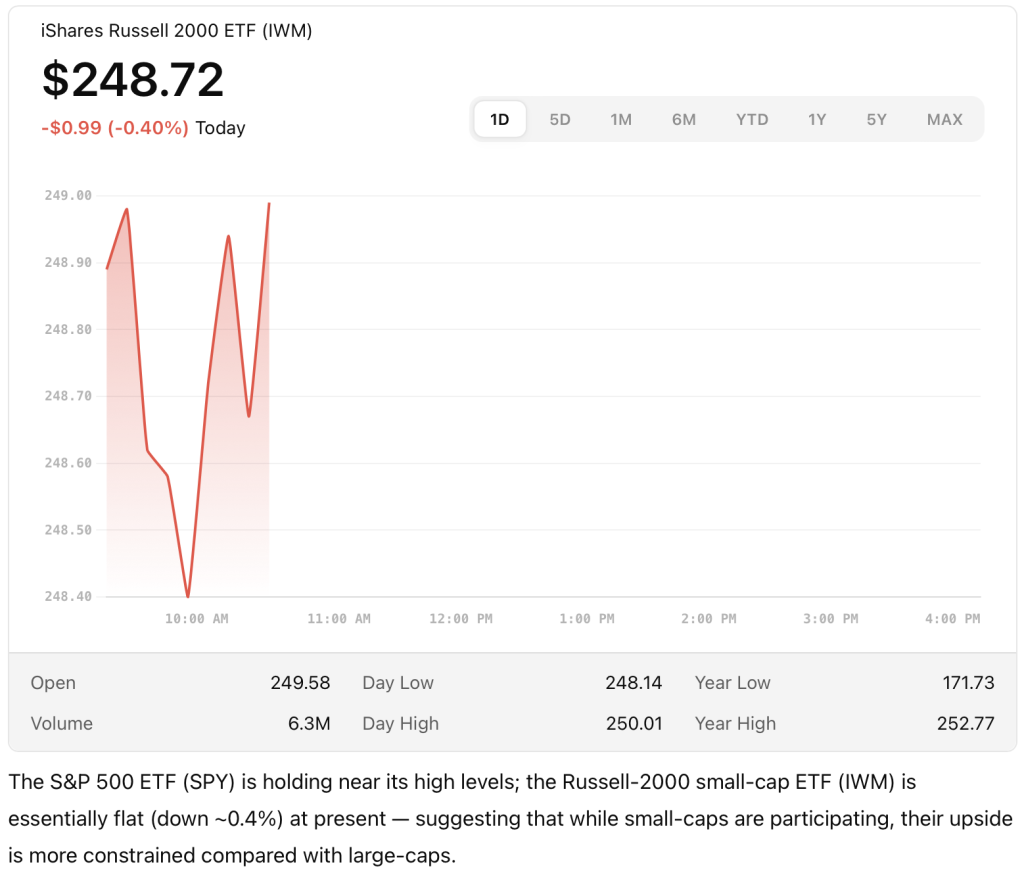

As noted, the Russell-2000 (via IWM) is flat to slightly down, while large-caps surge. This suggests small-caps are participating but not driving the advance.

With the concentration of returns more heavily skewed to the “Magnificent Seven”-type names, smaller stocks may be trading on the coattails of momentum but under tighter scrutiny.

Key constraints on small-caps today:

Increase in policy uncertainty: The Fed’s upcoming decisions might favour lower-risk large-caps that are seen as safer bets in a transition phase.

Sector composition: Small-cap indexes have more exposure to cyclical or domestically-oriented businesses which may suffer if global growth slips.

Valuation appetite: With megacaps still commanding front-stage, investors may be more selective in applying capital to smaller stocks unless they show strong growth or differentiated themes.

Potential upside for small-caps:

Should the Fed deliver a clear dovish tone and economic data stabilize, risk assets broadly may advance — giving small-caps a tailwind.

If the trade war dimming signals resolve into more concrete agreements, domestically-oriented companies (including many small-caps) could benefit.

A shift in investor preference toward “growth under the radar” may see some smaller names acting as beneficiaries of the AI/cyber/tech wave (if they have credible exposure).

Risks to monitor:

If the Fed cuts but signals worry that economic growth is weaker than expected, small-caps may lag (while large-caps, perceived as safer, hold up).

A surprise hawkish stance or an unforeseen negative macro shock could hit small-caps harder due to higher risk-premiums.

Liquidity and volatility: Smaller stocks tend to have wider bid-asks and higher susceptibility in risk-off moves.

In short, small-caps are in a patient mode — not leading, but with upside potential if the macro backdrop stays favourable and investor risk appetite strengthens.

4. Canada & Mexico: North-American Context

While most headlines focus on the U.S., the broader North-American market is also relevant for our readership.

Canada:

The Canadian equity market, while less covered, is benefitting from global risk-on flows and positive sentiment in resource/energy names (which often dominate in Canada).

Investors in Canadian small- and mid-cap issuers should watch foreign-exchange effects (CAD behaviour), commodity-prices, and domestic policy — all of which tie directly into valuations.

Mexico:

Mexican equities remain more exposed to global growth and commodity/currency risk, but gains in U.S. risk appetite typically help.

Trade policy remains a tail risk (given previously heightened tensions) and could impact exporters or companies tied to supply chains.

For the broader North-American region, the key takeaway is: U.S. leadership drives the tone, but Canada and Mexico provide diversification — including potential upside in smaller-market names if global risk turns more constructive.

5. What to Look for Going Forward

For investors tracking small-cap strategies or the broader market, here are the critical upcoming pivots:

a) Fed meeting outcome and forward guidance

The October 28–29 meeting is the major short-term catalyst. Investors will scrutinize not just the decision, but the language around economic growth, inflation, and the path of rate cuts. A dovish signal could spur additional small-cap upside. A cautious or hawkish tone could dampen momentum. marketwatch.com+1

b) Earnings from major tech and AI-players

The next wave of earnings (especially in tech/AI) will influence market leadership and sentiment. Since much of the rally is built on expectations of growth in these areas, any disappointment could ripple broadly. Investopedia+1

c) Small-cap earnings and growth visibility

Keep an eye on smaller companies reporting results. Positive earnings surprises in smaller or mid-cap names may prompt rotation into that space. Conversely, any signs of margin pressure or growth fatigue could signal caution.

d) Risk-assets vs safe-haven flows

With gold heading lower and safe-haven appeal waning, the market is leaning more into risk assets. That is a positive for small-caps — provided macro conditions remain stable. Reuters+1

e) Valuation and concentration risk

Even with the bullish backdrop, market concentration remains a theme: though U.S. markets are reportedly lessconcentrated than many believe, the dominance of large-caps means rotations into smaller stocks will require a shift in sentiment. Reuters

6. Editorial Take: The Small-Cap Opportunity in the Current Market

For readers of SmallCap Network, here’s how we interpret the current market in relation to our strategy:

The environment is constructive: with equities at highs, earnings strong, and policy expectations favourable, there is upside for smaller names — especially those with credible growth stories or niche exposure.

But caution is prudent: leadership is still heavily tilted toward large-caps and tech/AI. Small-caps must show differentiate growth or specialization to capture investor attention. Blunt broad exposure may suffice for general market participation, but will not drive outperformance.

Be selective: Focus on small-cap companies with:

Clear growth catalysts (product launches, niche market leadership)

Reasonable valuations (not overly stretched)

Some insulation from policy risk (or ability to benefit from potential rate cuts)

Good visibility into earnings in the near term

Watch rotation potential: If large-cap names begin to pause or disappoint, and if the Fed delivers a crystal-clear dovish message, we could see rotation into smaller, growth-oriented stocks. That would create a favourable environment for small-cap portfolios.

Manage risk: With valuations elevated and macro uncertainties (e.g., policy, global growth) still present, it is wise to maintain discipline. Diversification, stop-loss discipline, and clear thesis for each holding remain key.

7. Key Takeaways

North-American markets are at record highs, driven by tech/AI optimism, strong earnings, and anticipation of Fed policy easing.

Small‐caps are participating but currently playing catch-up to large-caps. The space is poised for upside, but market leadership must broaden for sustained move.

The coming days are critical: the Fed’s messaging, earnings rhythm, and sentiment shifts will determine whether small-caps can catch a bid or stay sidelined.

For thoughtful small-cap investors: this is a favorable backdrop, but the strategy must be selective, growth-oriented, and risk-aware rather than broad and speculative.

As the market enters this potentially pivotal phase, our recommendation is to monitor closely, adjust exposure intelligently, and position quietly for the possibility of a small-cap rotation. At the same time, don’t become complacent — elevated valuations and concentrated leadership always leave room for a pivot. The next week or two could define whether the small-cap segment begins a stronger move or remains on the sidelines of the broader rally.

Thank you for reading today’s overview. Stay tuned to SmallCap Network for further updates and deep dives as the earnings and policy calendar unfolds.

— SCN Editorial

Join our community to participate in comments, rate stocks, receive daily updates, and more.

SIMILAR ARTICLES

Small Cap Network

Small Cap Network

Small Cap Network

?