Investor Sentiment: Balancing Hope and Headwinds

Market Pulse: Cautious Gains Amid Uncertain Signals

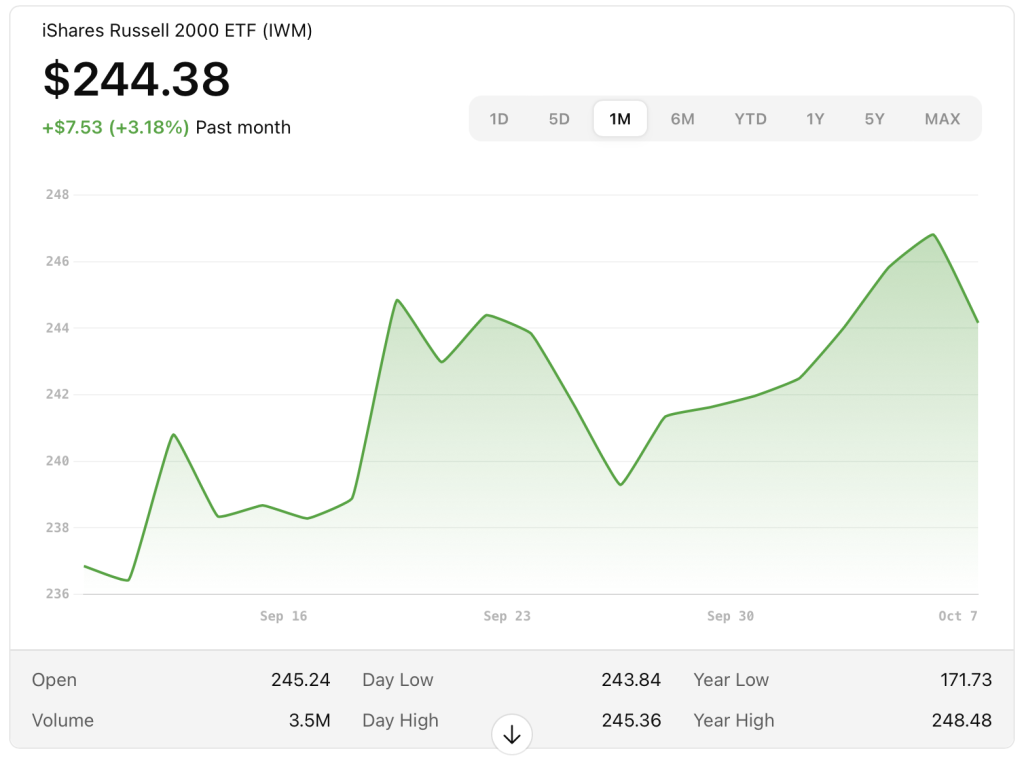

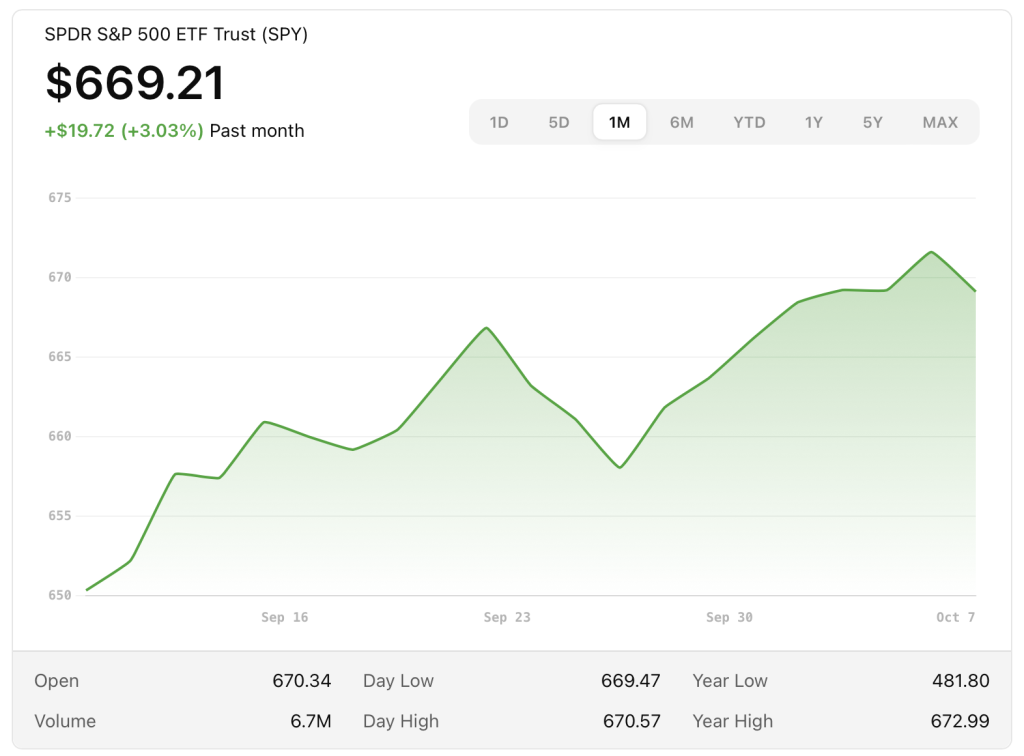

Wall Street is trading with a sense of cautious optimism. The SPDR S&P 500 ETF (SPY) is up modestly, and the iShares Russell 2000 ETF (IWM) — a proxy for small- to mid-cap stocks — is also inching higher.

Investor Sentiment: Balancing Hope and Headwinds

Wall Street is trading with a sense of cautious optimism. The SPDR S&P 500 ETF (SPY) is up modestly, and the iShares Russell 2000 ETF (IWM) — a proxy for small- to mid-cap stocks — is also inching higher. The broader equity market’s tone is tentative: while the headline large-cap indices linger near record highs, momentum is showing signs of fatigue, and market participants are acutely sensitive to macro surprises and central bank signals.

On Tuesday, equities gave back some of their recent gains. The S&P 500 slid 0.38 %, the Nasdaq fell 0.67 %, and the Dow dropped 0.20 % amid concerns about economic softness and the scarcity of fresh government data in the wake of the U.S. federal shutdown. Reuters

The narrative going into today has three main tensions: (1) AI-fueled exuberance and concentration risk among growth names, (2) macro data uncertainty (especially with key releases delayed by the shutdown), and (3) valuation vulnerability in an environment of thinner liquidity and cautious sentiment.

Macro & Policy Backdrop

U.S. Government Shutdown: The Data Blackout

The U.S. federal government has entered its second week of shutdown, following the expiration of key funding legislation on October 1. Wikipedia+1 This impasse has shuttered many agencies and delayed the release of critical economic reports — notably the September nonfarm payrolls, CPI, and retail sales — placing extra weight on private-sector surveys and regional indicators to fill the informational void. Kiplinger+1

Against this backdrop, speeches and minutes from the Federal Open Market Committee (FOMC) are now even higher-leverage events. The market is especially watching for insights into how the Fed views the tradeoff between inflation pressures and growth uncertainty. Investopedia

Oil, Commodities & Crosswinds

Oil prices are on the rise after OPEC+ opted for a modest supply increase of 137,000 barrels per day for November — a restrained approach that calmed oversupply fears. Reuters In response, Brent crude has gained 0.7 %, and U.S. WTI has advanced 0.8 %. Reuters Meanwhile, copper and base metals are under pressure amid global growth concerns and China-led demand softness — a headwind for many resource-lean economies.

In the mining sector, Freeport-McMoRan (FCX) is drawing attention: Morgan Stanley reduced its target to $46 from $48 while retaining an overweight view, citing weaker near-term catalysts. MarketBeat

Dollar’s Decline & Multinational Strength

A depreciating U.S. dollar has been a tailwind for multinational companies with substantial foreign earnings exposure. The recent decline has created a sharp divergence between the performance of globally diversified large caps and more domestically oriented names. Financial Times The implication: in a late-cycle environment, companies with international scale may continue to outperform, even if domestic demand cools.

However, this same dynamic can squeeze smaller firms that rely more on imports, local supply chains, or domestic revenue.

Large Caps & Sector Moves

AI Mania, but at What Cost?

Investor enthusiasm remains firmly centered on AI, cloud infrastructure, and semiconductor plays. The recent AMD–OpenAI deal electrified the market, pushing chip and AI adjacencies higher. Reuters+2AP News+2 However, regulatory scrutiny and warnings from institutions like the Bank of England heighten concern about concentration risk in the tech sector. The BoE flagged valuations among U.S. tech names as “stretched,” drawing parallels to dot-com excesses. MarketWatch

That said, defensive and non-tech sectors are showing signs of life. Utilities, energy, and select industrials are attracting capital as investors hedge their bets against a sharp reversion in growth names.

Corporate Surprises

In automotive supply, an old fire is resurfacing. A September 16 fire at Novelis’ Oswego aluminum plant — a key supplier to Ford — is now exerting renewed pressure on Ford’s production outlook. Shares plunged 5.2 % following investor reassessment of the disruption’s timeline. Barron’s

Across big miners, Freeport’s revisions (noted above) point to broader caution in resource plays, even as the commodity backdrop is mixed.

Cross-Border & Canadian Highlights

On the Canadian front, Hut 8 Corp. (TSE:HUT) — a bitcoin miner — rose to a new 52-week high, logging significant volume. MarketBeat The broader Canadian equity market is benefitting from trough valuations in certain sectors and relative insulation from U.S. regulatory noise. Still, Canadian small-cap names remain more sensitive to local economic headlines and commodity cycles.

The Small-Cap Landscape: Opportunities and Risks

Small-cap names are navigating a narrower path today — buoyed by value and recovery plays, but vulnerable to volatility and macro surprises.

Upgrades & Insider Activity

Several small-cap stocks are drawing interest:

-American Coastal Insurance Corp (ACIC) was upgraded under the Validea/Motley Fool Small-Cap Growth strategy, moving from 56% to 83% based on fundamental metrics and valuation. Nasdaq

-Rocky Brands Inc (RCKY) was elevated in the Benjamin Graham deep-value screen (from 71% to 86%), signaling value-minded investors might be eyeing its structural earnings and balance sheet. Nasdaq

Insider buying, distribution patterns, and niche catalysts are all under sharper scrutiny for small-caps today as external macro buffers weaken.

Performance Bifurcation

The Russell 2000 (tracked by IWM) is up modestly today, but it’s lagging the large-cap rally in strength and conviction. Many small-cap stocks are attempting to regain footing after recent repricing pressures. The lack of new macro data makes it harder to lean proactively into speculative names.

There are pockets of outperformance — especially in sectors tied to AI, cloud, and edge infrastructure — but the key difference from large caps is that tailwinds are thinner, and downside risk is steeper in small-cap names during times of stress.

Key Factors to Watch

-Liquidity and bid depth: Small-caps are more vulnerable to abrupt swings when institutional flows turn.

-Earnings surprises: With macro guidance murky, companies that beat estimates or raise guidance will draw outsized attention.

-M&A and catalysts: Many small-caps are more mergerable or subject to takeover rumors; thus, deal flow is a potential driver in this regime.

-Sectoral skew: Small-cap exposure in energy, industrials, specialty tech, and regional plays may outperform broader small-cap indexes.

Risks, Watch Points & Scenario Mapping

Risk Scenarios

-Fed hawkish pivot — If FOMC minutes reveal a greater bias toward rate hikes (citing inflation or signal breakdowns), markets may sell off sharply.

-Prolonged shutdown / political brinksmanship — The longer the U.S. government remains shuttered, the greater the erosion of investor confidence and macro visibility.

-Tech correction / re-rating — A pullback in AI/semiconductor names could cascade into index-wide weakness, especially as concentration risk is already cited. MarketWatch

-Commodity or geopolitical shock — A sudden move in oil, copper, or geopolitical spats (e.g. tariffs, supply bottlenecks) could shock resource-sensitive names and markets.

Things to Watch Today

-Release of FOMC minutes (for clues on Fed balance and rate path) Investopedia+1

-Any unofficial or alternative data releases (private surveys, regional Fed reports) to fill the government-data gap

-Updates from big tech / AI pairs — any surprise regulatory, earnings, or deal-related announcements

-Movements in 10-year Treasury yields and the yield curve — as tension between growth and inflation narratives plays out

-Tracking small-cap breadth (advancers vs. decliners) for signs of internal strength or weakness

Bottom Line & Strategic Thoughts (SCN Outlook)

Today’s market environment is one of fragile optimism. The large-cap indices retain upward drift, thanks largely to the AI narrative and global income tailwinds, but anything that weakens sentiment or unveils cracks in valuation will quickly test breadth.

Small-caps are in a more precarious position: they require conviction to navigate, but also offer asymmetry — when they break out, they can outperform strongly. The trick lies in selectivity, risk management, and patience.

For SCN’s readers and small-cap investors, here’s how we’re thinking about allocation and watchlists today:

-Maintain a core allocation to large-cap “defensive growth” themes (quality, multinational revenue, AI infrastructure).

-Allocate a tactical sleeve to small-caps that have strong fundamentals, insider support, or clear catalysts (e.g. ACIC, RCKY).

-Keep dry powder in case of a pullback — the next chapters will likely present opportunity in sideways or corrective phases.

-Hedge where possible — in small-caps especially, trailing stops, options, or risk overlays may be prudent.

We’ll be watching the FOMC minutes, private indicators, and any signs that the tech rally is becoming overextended. Unless one of those breaks sharply, we expect the equity market to grind upward — though not without volatility — into year-end.

Stay tuned. SCN will continue to track both the marquee names and the undercurrents driving small-cap momentum.

Join our community to participate in comments, rate stocks, receive daily updates, and more.

SIMILAR ARTICLES

Small Cap Network

Small Cap Network

Small Cap Network

?