iCloud alternative for Android’s 3.5 billion users.

From Instagram to MiMedia: Why Tech Giants Pay Billions for Platforms with Scale

When Facebook acquired Instagram in 2012 for $1 billion, the tech world was stunned. At the time, Instagram had just 30 million users and zero revenue. Critics called the deal overpriced. Yet today, Instagram is worth over $100 billion on its own, generating tens of billions annually for Meta.

Jim Robertson

SmallCap Network (SCN)

When Facebook acquired Instagram in 2012 for $1 billion, the tech world was stunned. At the time, Instagram had just 30 million users and zero revenue. Critics called the deal overpriced. Yet today, Instagram is worth over $100 billion on its own, generating tens of billions annually for Meta.

The story has repeated itself across tech history:

WhatsApp: Acquired by Meta for $19B in 2014 with little revenue, but huge global scale.

YouTube: Bought by Google in 2006 for $1.65B when it was barely monetized.

LinkedIn: Acquired by Microsoft for $26.2B in 2016 to lock in scale and network effects.

The lesson is clear: scale matters. Tech giants are willing to pay eye-watering sums for platforms with a large, engaged user base, even if the monetization is still in its early stages.

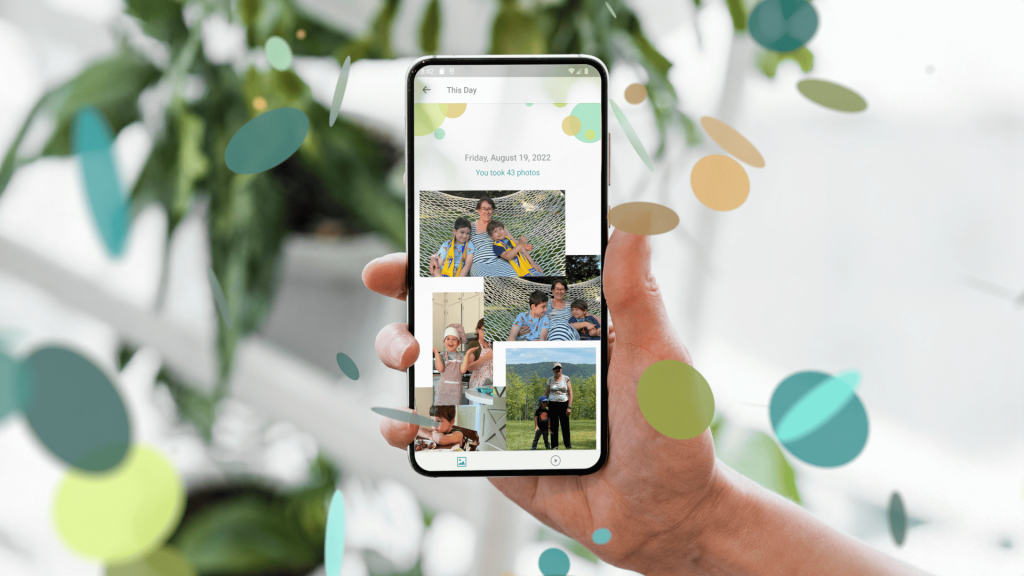

Now, a new name is emerging on the radar: MiMedia Holdings Inc. (TSXV: MIM | OTCQB: MIMDF | FSE: KH3). With its AI-powered cloud storage and mobile advertising platform, MiMedia is positioning itself as the iCloud alternative for Android’s 3.5 billion users. And for investors, that puts it squarely in the playbook of past billion-dollar acquisitions.

Why Scale Is the New Currency

In today’s digital economy, scale equals defensibility. The more users a platform has, the harder it is for competitors to displace it. Scale also creates network effects, where the value of the service increases as more people use it.

For acquirers like Google, Apple, Microsoft, and Meta, buying scale is often faster and more cost-effective than building it. That’s why they’ve repeatedly shelled out billions for platforms with sticky user bases.

MiMedia is built around this principle. By partnering with telecom giants and OEMs, it ensures its app is preloaded onto millions of devices, instantly giving it scale at the distribution level. Instead of fighting for downloads in app stores, MiMedia is delivered automatically to consumers through carrier partnerships.

MiMedia’s Distribution Engine

MiMedia’s path to scale is unique. Instead of relying on expensive consumer marketing, it partners with companies that already have massive reach:

-América Móvil: The #1 telecom provider in Latin America.

-Telcel and Altán Redes: Additional telecom reach in Mexico.

-Orbic & Schok: OEM device partners, including rugged smartphones like Caterpillar-branded devices.

-Walmart’s Bait (Mexico): #3 telecom carrier with 18M+ subscribers.

Through these deals, MiMedia is targeting deployment on 40M devices. That’s not a pipe dream, it’s backed by signed contracts.

For context: Instagram had 30M users when it was acquired. MiMedia could easily surpass that milestone in its first rollout phase.

Why Tech Giants Pay for Scale

To understand why MiMedia could be attractive to a buyer, it helps to revisit why past acquisitions happened:

-Instagram (Meta, $1B): Facebook saw a threat in mobile-first photo sharing and acquired it for scale and engagement.

-WhatsApp (Meta, $19B): Global user base with unmatched engagement in messaging; revenue came later.

-YouTube (Google, $1.65B): Dominated video scale before monetization was established.

-LinkedIn (Microsoft, $26.2B): Owned professional scale and data, critical to Microsoft’s enterprise ecosystem.

In each case, scale plus engagement outweighed near-term revenue. Today, those platforms generate billions annually.

MiMedia’s value lies in the same combination: scale + engagement + monetization potential.

The Monetization Flywheel

What makes MiMedia more compelling than some past acquisitions is that it already has a monetization model baked in:

-Mobile Advertising: Ads served within MiMedia’s platform target engaged users as they scroll through their personal content galleries. With global mobile ad spend projected to hit $1 trillion by 2032, MiMedia has a direct line into this revenue pool.

-Cloud Subscriptions: Like iCloud, MiMedia offers free storage tiers but nudges users toward paid upgrades. Even a modest 1-3% conversion rate across millions of devices translates to $20-$40M in recurring annual revenue.

-Enterprise & Vertical Applications: Rugged smartphone integration creates potential subscription upgrades from industries like construction and emergency response.

This dual-revenue model, ads + subscriptions, means MiMedia is not just about scale, but also about sustainable monetization.

Why MiMedia Could Be a Buyout Target

Tech giants are always on the hunt for platforms that combine scale and defensibility. Here’s why MiMedia could be on their radar:

-Unique Positioning: It’s the only cloud platform designed as a user friendly alternative for the native gallery.

-Distribution Partnerships: Telecom and OEM contracts create baked-in growth that rivals can’t replicate overnight.

-Defensibility: 16 issued patents and $50M in R&D protect the technology.

-Revenue Potential: $200M+ gross revenue projected from 35M devices.

-Buyout Precedent: Big tech has repeatedly paid billions for platforms with scale and user data.

If history repeats, MiMedia could be worth many multiples of its current valuation as acquirers look to lock in Android’s underserved market.

The Android Opportunity

Apple’s iCloud has already proven the value of consumer cloud subscriptions. But iCloud only serves Apple’s 1.5 billion users. Android, with its 3.5 billion global users, has no unified iCloud-like service.

MiMedia is stepping directly into that gap. With even a small percentage of adoption across the Android ecosystem, MiMedia could achieve hundreds of millions of active users, a scale that makes it irresistible to buyers.

Risks and Considerations

Of course, investors should also weigh the risks:

-Adoption Pace: Preloading ensures distribution, but user engagement is key.

-Competition: Multiple galleries and cloud services exist in the market.

-Execution Risk: Delivering seamless integration across multiple carriers and OEMs is complex.

However, the combination of distribution contracts and defensible IP makes MiMedia’s path clearer than most small-cap peers.

SCN Investor Takeaway

History has shown that platforms with scale get acquired for billions. Instagram, WhatsApp, YouTube, and LinkedIn all started as “early-stage” platforms with growing but under-monetized user bases. Today, they’re cornerstones of their parent companies.

MiMedia is building the same foundation, but with two added advantages:

-Monetization built in from day one through ads and subscriptions.

-Defensible IP that makes replication risky for competitors.

For retail investors, MiMedia represents a rare chance to invest in a small-cap with the potential DNA of a billion-dollar buyout. The story is still early, but the scale engine is already in motion.

From a value perspective, is MiMedia the next Instagram? Possibly. The next WhatsApp? Maybe. One thing is clear: MiMedia has positioned itself to potentially be the next big target in the tech acquisition playbook.

Learn More: Visit MiMedia’s Investor Page

Join our community to participate in comments, rate stocks, receive daily updates, and more.

SIMILAR ARTICLES

Small Cap Network

Small Cap Network

Small Cap Network

?